Redbox 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We are generally not subject to income tax examination in jurisdictions within the United States for years prior

to 1995. For non United States jurisdictions, we are generally not subject to income tax examination for years prior

to 1998.

Research and development: Costs incurred for research and development activities are expensed as incurred.

Software costs developed for internal use are accounted for under Statement of Position (“SOP”) 98-1, Accounting

for the Costs of Computer Software Developed or Obtained for Internal Use.

Recent accounting pronouncements: In September 2006, the FASB issued FASB Statement No. 157, Fair

Value Measures (“SFAS 157”), which defines fair value, establishes a framework for measuring fair value and

enhances disclosures about fair value measures required under other accounting pronouncements, but does not

change existing guidance as to whether or not an instrument is carried at fair value. The effective date of SFAS 157

for nonfinancial assets and liabilities has been delayed by one year to fiscal years beginning after November 15,

2008. We are currently reviewing the provisions of SFAS 157 to determine the impact to our Consolidated Financial

Statements.

In February 2007, the FASB issued FASB Statement No. 159, The Fair Value Option for Financial Assets and

Financial Liabilities — including an amendment to FASB Statement No. 115 (“SFAS 159”). Under SFAS 159,

entities may elect to measure specified financial instruments and warranty and insurance contracts at fair value on a

contract-by-contract basis, with changes in fair value recognized in earnings each reporting period. The election,

called the fair value option, will enable entities to achieve an offset accounting effect for changes in fair value of

certain related assets and liabilities without having to apply complex hedge accounting provisions. SFAS 159 is

effective for fiscal years beginning after November 15, 2007. The adoption of the provisions of SFAS 159 is not

expected to have a material impact to our Consolidated Financial Statements.

In December 2007, the FASB issued FASB Statement No. 141 (revised 2007), Business Combinations

(“SFAS 141R”). SFAS 141R, retains the fundamental requirements of Statement No. 141 to account for all business

combinations using the acquisition method (formerly the purchase method) and for an acquiring entity to be

identified in all business combinations. However, the new standard requires the acquiring entity in a business

combination to recognize all the assets acquired and liabilities assumed in the transaction; establishes the

acquisition-date fair value as the measurement objective for all assets acquired and liabilities assumed; and

requires the acquirer to disclose the information they need to evaluate and understand the nature and financial effect

of the business combination. SFAS 141R is effective for acquisition made on or after the first day of annual periods

beginning on or after December 15, 2008. We are currently reviewing the provisions of SFAS 141R to determine the

impact to our Consolidated Financial Statements.

In December 2007, the FASB issued FASB Statement No. 160, Noncontrolling Interests in Consolidated

Financial Statements — An Amendment of ARB No. 51 (“SFAS 160”). SFAS 160 establishes new accounting and

reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary.

SFAS 160 is effective for annual periods beginning on or after December 15, 2008. We are currently reviewing the

provisions of SFAS 160 to determine the impact to our Consolidated Financial Statements.

Reclassifications: Certain reclassifications have been made to the prior year amounts to conform to the

current year presentation.

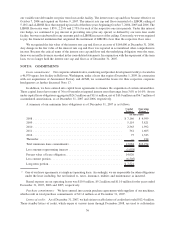

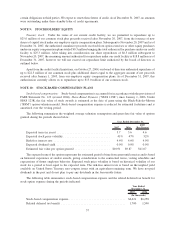

NOTE 3: ACQUISITIONS

In connection with our acquisitions, we have allocated the respective purchase prices plus transaction costs to

the estimated fair values of the tangible and intangible assets acquired and liabilities assumed. These purchase price

allocation estimates were based on our estimates of fair values.

Video Vending New York, Inc. (d.b.a. “DVDXpress”): In 2005, we entered into a credit agreement, which was

subsequently amended, to provide DVDXpress with a credit facility to provide up to $9.9 million in financing. In

addition, we signed an asset purchase option agreement in 2005 and on September 27, 2007, we provided notice of

exercise of the option and acquired substantially all of DVDXpress’ assets and certain liabilities in exchange for a

cash payment of $2.7 million, their outstanding debt and accrued interest of $8.4 million on the credit facility plus

contingent consideration up to $1.0 million based on the achievement of specific conditions. In December 2007, the

52