Redbox 2007 Annual Report Download - page 37

Download and view the complete annual report

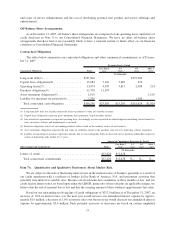

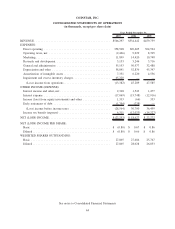

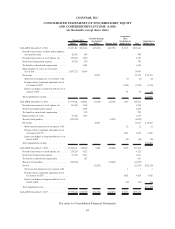

Please find page 37 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) In the third quarter of 2007, we recognized a telecommunication fee refund which is more fully described in Note 2 and Note 17 to our

Consolidated Financial Statements.

(3) In the second quarter of 2006, we acquired CMT.

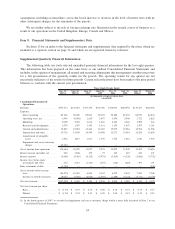

Seasonality

We have historically experienced seasonality in our revenues with higher revenues in the second half of the

year than in the first half of the year. Our coin services generally experiences its highest revenues in the third

calendar quarter, followed by the fourth calendar quarter, and relatively lower revenues in the first half of the year.

Our e-payment services (including money transfer) generally provides its highest revenue in the fourth quarter. We

have not experienced significant seasonality in our entertainment services. We expect our results of operations will

continue to fluctuate as a result of seasonal fluctuations and our revenue mix between relatively higher margin coin

and e-payment services and relatively lower margin entertainment services.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

None.

Item 9A. Controls and Procedures.

(i) Disclosure Controls and Procedures.

Our Chief Executive Officer and Chief Financial Officer conducted an evaluation of the effectiveness of our

disclosure controls and procedures (as defined under Rule 13a-15(e) of the Securities Exchange Act of 1934). Based

on that evaluation, the Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls

and procedures were effective as of December 31, 2007.

(ii) Internal Control Over Financial Reporting.

(a) Management’s report on internal control over financial reporting.

Our management is responsible for establishing and maintaining adequate internal control over financial

reporting, as such term is defined in the Securities Exchange Act of 1934 Rule 13a-15(f). Under the supervision and

with the participation of our management, including our Chief Executive Officer and Chief Financial Officer, we

conducted an evaluation of the effectiveness of our internal control over financial reporting as of December 31,

2007 as required by the Securities Exchange Act of 1934 Rule 13a-15(c). In making this assessment, we used the

criteria set forth in the framework in Internal Control-Integrated Framework issued by the Committee of Sponsoring

Organizations of the Treadway Commission. Based on our evaluation under the framework in Internal Control-

Integrated Framework, our management concluded that our internal control over financial reporting was effective as

of December 31, 2007.

(b) Attestation report of the registered public accounting firm.

The attestation report of KPMG LLP, our independent registered public accounting firm, on the effectiveness

of our internal control over financial reporting is set forth on page 41.

(c) Changes in internal control over financial reporting.

There was no change in our internal control over financial reporting during our fourth fiscal quarter ended

December 31, 2007 that has materially affected, or is reasonably likely to materially affect, our internal control over

financial reporting.

Item 9B. Other Information.

None.

35