Redbox 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.e-payment-enabled coin-counting machines in supermarkets, drugstores, universities, shopping malls and conve-

nience stores.

We have relationships with national wireless carriers, such as Sprint, Verizon, T-Mobile, Virgin Mobile and

AT&T. We generate revenue primarily through commissions or fees charged per e-payment transaction and pay our

retailers a fee based on commissions earned on the sales of e-payment services.

Recent Events

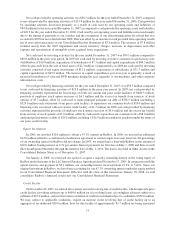

On January 1, 2008, we exercised our option to acquire a majority ownership interest in the voting equity of

Redbox under the terms of the LLC Interest Purchase Agreement dated November 17, 2005. In conjunction with the

option exercise and payment of $5.1 million, our ownership interest increased from 47.3% to 51.0%. Since our

original investment in Redbox, we have been accounting for our 47.3% ownership interest under the equity method

in our Consolidated Financial Statements. Along with our acquisition of DVDXpress in October 2007 and the

majority ownership in Redbox, we offer self-service DVD kiosks where consumers can rent or purchase movies.

Our DVD kiosks supply all the functionality of a traditional video rental store, yet occupy an area of less than ten

square feet. Consumers use a touch screen to select their DVD, swipe a valid credit or debit card, and go. The

process is designed to be fast, efficient and fully automated with no upfront or membership fees. Typically, the DVD

rental price is a flat fee plus tax for one night and if the consumer chooses to keep the DVD for additional nights,

they are automatically charged the same flat fee price. Our DVD kiosks are available in all states in the continental

United States and Puerto Rico and offer our consumers with a more convenient home entertainment solution. We

generate revenue primarily through fees charged to rent or purchase a DVD, which our retail partners receive a

percentage of our fee.

In February 2008, we reached an agreement with Wal-Mart to significantly expand our Redbox DVD kiosks

installed at Wal-Mart locations over the next 12 to 18 months.

As of January 18, 2008, the financial results of Redbox will be consolidated into our financial statements.

Further, we will recognize a reduction of minority interests on the Consolidated Statement of Operations relating to

the 49% equity interest to which we do not own. We expect our 2008 consolidated revenues to significantly increase

due to the consolidation of Redbox and we further expect our consolidated operating expenses will increase

accordingly.

Effective January 1, 2008, we completed the acquisition of GroupEx Financial Corporation, JRJ Express Inc.

and Kimeco, LLC (collectively, “GroupEx”), for an aggregate purchase price of up to $70.0 million. The purchase

price includes a $60.0 million cash payment (subject to a customary working capital adjustment) at closing. Of the

$60.0 million paid at closing, $6.0 million is being held in escrow as partial security for the indemnification

obligations of the sellers under the agreement until the earlier of (1) the date eighteen months following the closing

and (2) the date thirty days after completion in calendar year 2009 of the 2008 calendar year audit. An additional

$34.0 million of the $60.0 million paid at closing is being held in escrow as partial security for the indemnification

obligations of the sellers under the agreement with respect to a lawsuit against GroupEx and one of the sellers,

which will be held until a final court order or written settlement agreement resolving such lawsuit has been

obtained. In addition, there is a contingent payment of up to $10.0 million should certain performance conditions be

met in the fifteen months following the closing.

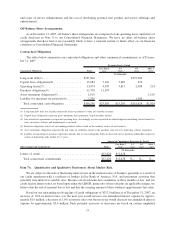

Critical Accounting Policies and Estimates

Our discussion and analysis of our financial condition and results of operations is based upon our Consolidated

Financial Statements, which have been prepared in accordance with accounting principles generally accepted in the

United States of America (“GAAP”). The preparation of these financial statements requires us to make estimates

and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure

of contingent assets and liabilities. We evaluate our estimates on an ongoing basis. Our estimates are based on

historical experience and on various other assumptions that are believed to be reasonable under the circumstances,

the results of which form the basis for making judgments about the carrying values of assets and liabilities that are

not readily apparent from other sources. Actual results may differ from these estimates under different assumptions

or conditions.

23