Redbox 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assurance, however, that the disagreement will be settled amicably, and litigation may commence. In April 2007, we

received a request for arbitration filed by ScanCoin AB (“ScanCoin”) before the Arbitration Institute of the

Stockholm Chamber of Commerce regarding ownership of intellectual property related to an agreement between

Coinstar and ScanCoin dated April 23, 1993. The parties have selected arbitrators, and we advanced partial payment

for the arbitration. In August 2007, we received ScanCoin’s statement of claim. ScanCoin seeks a declaration of

ownership of over 70 of our patents and patent applications related to our coin-counting machines, as well as

monetary damages of approximately $8 million, plus interest. We believe that ScanCoin’s claims against us are

without merit and intend to defend ourselves vigorously in this arbitration. In October 2007, we filed a claim in

United States District Court for the Northern District of Illinois against ScanCoin North America alleging that it is

infringing on a patent we own relating to self-service coin machines.

NOTE 15: BUSINESS SEGMENT INFORMATION

FASB Statement No. 131, Disclosure about Segments of an Enterprise and Related Information, requires that

companies report separately in the financial statements certain financial and descriptive information about

operating segments profit or loss, certain specific revenue and expense items and segment assets. The method

for determining what information is reported is based on the way that management organizes the operating

segments for making operational decisions and assessments of financial performance. Our chief operating decision

maker is considered to be the Chief Executive Officer (“CEO”).

We are organized into two reportable business segments: the North American business (which includes the

United States, Canada and Mexico), and our International business (which primarily includes the United Kingdom

as well as other European operations of CMT). The total revenue of the North American segment mainly relates to

operations located within the United States, and the total revenue of the International segment mainly relates to the

operations located within the United Kingdom. Goodwill from the acquisition of CMT has been included in the

International business segment. Goodwill arising in all other acquisitions has been allocated to our North American

business segment. The entire charge in 2007 for asset impairment and inventory write-off has been allocated to our

North American business segment.

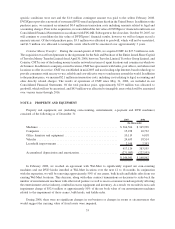

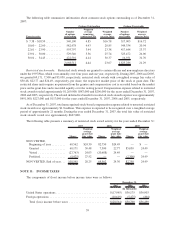

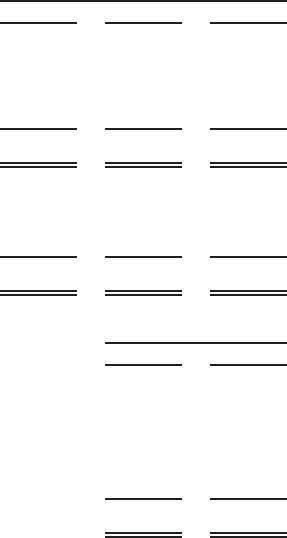

2007 2006 2005

Year Ended December 31,

(In thousands)

Revenue:

North American business ........................... $489,462 $500,462 $438,482

International business .............................. 56,835 33,980 21,257

Total revenue .................................. $546,297 $534,442 $459,739

Net (loss) income:

North American business ........................... $(11,635) $ 22,935 $ 22,402

International business .............................. (10,618) (4,308) (130)

Total net (Ioss) income ........................... $(22,253) $ 18,627 $ 22,272

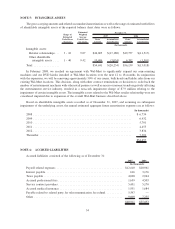

2007 2006

December 31,

(In thousands)

Total assets:

North American business ..................................... $726,098 $694,650

International business........................................ 129,092 86,703

Intercompany eliminations .................................... (86,617) (63,270)

Total assets ............................................. $768,573 $718,083

Currently, management does not use product line financial performance as a basis for business operating

decisions. However, our CEO does analyze our revenue based on revenue generated from our coin-counting and

63