Redbox 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

specific conditions were met and the $1.0 million contingent amount was paid to the sellers February 2008.

DVDXpress provides a network of automated DVD rental and purchase kiosk in the United States. In addition to the

purchase price, we incurred an estimated $0.4 million in transaction costs including amounts related to legal and

accounting charges. Prior to the acquisition, we consolidated the fair value of DVDXpress’ financial results into our

Consolidated Financial Statements in accordance with FIN 46R. Subsequent to the close date, October 30, 2007, we

will continue to consolidate the fair value of DVDXpress’ financial results, however we will no longer record a

minority interest. Of the total purchase price, $5.3 million was allocated to goodwill, which will not be amortized,

and $1.5 million was allocated to intangible assets which will be amortized over approximately 3 years.

Coinstar Money Transfer: During the second quarter of 2006, we acquired CMT for $27.5 million in cash.

The acquisition was effected pursuant to the Agreement for the Sale and Purchase of the Entire Issued Share Capital

of Travelex Money Transfer Limited dated April 30, 2006, between Travelex Limited, Travelex Group Limited, and

Coinstar. CMT is one of the leading money transfer networks in terms of agent locations and countries in which we

do business. In addition to company-owned locations, CMT has agreements with banks, post offices, and other retail

locations to offer its service. CMT was established in mid-2003 and uses leading edge Internet-based technology to

provide consumers with an easy-to-use, reliable and cost-effective way to send money around the world. In addition

to the purchase price, we incurred $2.1 million in transaction costs, including costs relating to legal, accounting and

other directly related charges. The results of operations of CMT since May 31, 2006, are included in our

Consolidated Financial Statements. Of the total purchase price, approximately $23.9 million was allocated to

goodwill, which will not be amortized, and $8.9 million was allocated to intangible assets which will be amortized

over various terms through 2016.

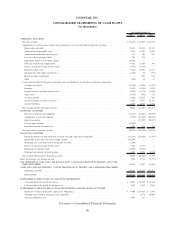

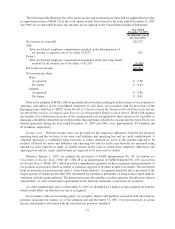

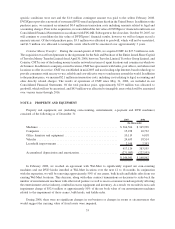

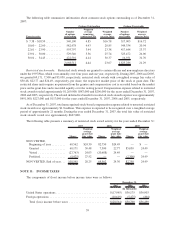

NOTE 4: PROPERTY AND EQUIPMENT

Property and equipment, net (including coin-counting, entertainment, e-payment and DVD machines)

consisted of the following as of December 31:

2007 2006

(In thousands)

Machines ................................................. $364,564 $ 345,938

Computers ................................................ 15,238 10,732

Office furniture and equipment ................................. 10,119 6,018

Vehicles .................................................. 24,655 18,514

Leasehold improvements . . . ................................... 2,548 2,353

417,124 383,555

Accumulated depreciation and amortization ........................ (271,083) (222,593)

$ 146,041 $ 160,962

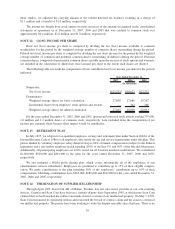

In February 2008, we reached an agreement with Wal-Mart to significantly expand our coin-counting

machines and our DVD kiosks installed at Wal-Mart locations over the next 12 to 18 months. In conjunction

with the expansion, we will be removing approximately 50% of our cranes, bulk heads and kiddie rides from our

existing Wal-Mart locations. This decision, along with other contract terminations or decisions to scale-back the

number of entertainment machines with other retail partners as well as macro-economic trends negatively affecting

the entertainment service industry, resulted in excess equipment and inventory. As a result, we recorded a non-cash

impairment charge of $52.6 million or approximately 50% of the net book value of our entertainment machines

related to the impairment of these cranes, bulk heads, and kiddie rides.

During 2006, there were no significant changes in our business or changes in events or circumstances that

would suggest the carrying value of fixed assets were impaired.

53