Redbox 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

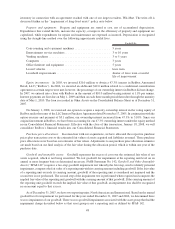

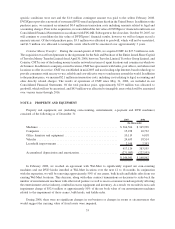

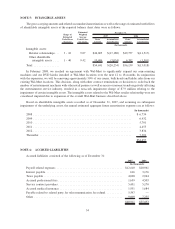

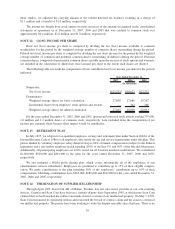

NOTE 5: INTANGIBLE ASSETS

The gross carrying amounts and related accumulated amortization as well as the range of estimated useful lives

of identifiable intangible assets at the reported balance sheet dates were as follows:

Range of

Estimated

Useful Lives

(in years)

Estimated

Weighted

Average

Useful Lives

(in years)

Gross

Amount

Accumulated

Amortization

Gross

Amount

Accumulated

Amortization

2007 2006

December 31,

(In thousands)

Intangible assets:

Retailer relationships . . . 3 - 10 9.07 $44,005 $(17,180) $49,757 $(11,517)

Other identifiable

intangible assets .... 1-40 9.42 10,686 (3,054) 6,382 (1,501)

Total ................ $54,691 $(20,234) $56,139 $(13,018)

In February 2008, we reached an agreement with Wal-Mart to significantly expand our coin-counting

machines and our DVD kiosks installed at Wal-Mart locations over the next 12 to 18 months. In conjunction

with the expansion, we will be removing approximately 50% of our cranes, bulk heads and kiddie rides from our

existing Wal-Mart locations. This decision, along with other contract terminations or decisions to scale-back the

number of entertainment machines with other retail partners as well as macro-economic trends negatively affecting

the entertainment service industry, resulted in a non-cash impairment charge of $7.9 million relating to the

impairment of certain intangible assets. The intangible assets related to the Wal-Mart retailer relationship were not

considered impaired due to expansion of the overall Wal-Mart business described above.

Based on identifiable intangible assets recorded as of December 31, 2007, and assuming no subsequent

impairment of the underlying assets, the annual estimated aggregate future amortization expenses are as follows:

(In thousands)

2008 ............................................................. $ 6,734

2009 ............................................................. 6,432

2010 ............................................................. 5,701

2011 ............................................................. 4,455

2012 ............................................................. 3,834

Thereafter ......................................................... 7,301

$34,457

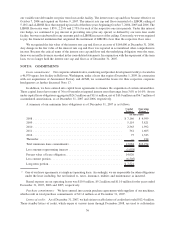

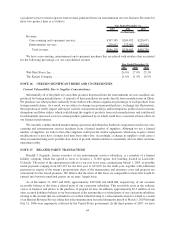

NOTE 6: ACCRUED LIABILITIES

Accrued liabilities consisted of the following as of December 31:

2007 2006

(In thousands)

Payroll related expenses ......................................... $12,610 $10,961

Interest payable ............................................... 616 3,176

Taxes payable ................................................. 4,068 2,944

Accrued professional fees ........................................ 1,659 4,503

Service contract providers ........................................ 5,451 5,170

Accrued medical insurance ....................................... 1,951 1,684

Payable related to related party for telecommunication fee refund........... 5,547 —

Other ....................................................... 9,009 7,255

$40,911 $35,693

54