Redbox 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and scope of service enhancements and the cost of developing potential new product and service offerings and

enhancements.

Off-Balance Sheet Arrangements

As of December 31, 2007, off-balance sheet arrangements are comprised of our operating leases and letters of

credit disclosed in Note 8 to our Consolidated Financial Statements. We have no other off-balance sheet

arrangements that have had or are reasonably likely to have a material current or future effect on our financial

condition or Consolidated Financial Statements.

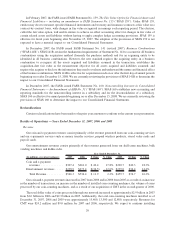

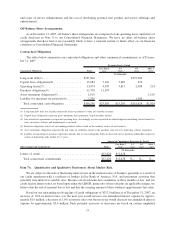

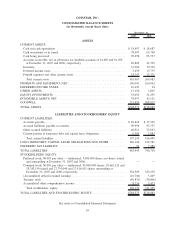

Contractual Obligations

The tables below summarize our contractual obligations and other commercial commitments as of Decem-

ber 31, 2007:

Contractual Obligations Total

Less than 1

year

1-3

years

4-5

years

After 5

years

Payments Due by Period

(In thousands)

Long-term debt(1)........................ $257,000 $257,000

Capital lease obligations(2) . . . .............. 15,084 7,166 7,482 436

Operating leases(3) ....................... 13,974 4,959 5,813 2,988 214

Purchase obligations(4) .................... 11,378 11,378

Asset retirement obligations(5) .............. 1,610 1,610

Liability for uncertain tax positions(6) ......... 1,200 1,200

Total contractual cash obligations .......... $300,246 $23,503 $13,295 $261,624 $1,824

(1) Long-term debt does not include contractual interest payments as they are variable in nature.

(2) Capital lease obligations represent gross minimum lease payments, which includes interest.

(3) One of our lease agreements is a triple net operating lease. Accordingly, we are responsible for other obligations including, but not limited to,

taxes, insurance, utilities and maintenance as incurred.

(4) Purchase obligations consist of outstanding purchase orders issued in the ordinary course of our business.

(5) Asset retirement obligations represent the fair value of a liability related to the machine removal costs following contract expiration.

(6) Liability for uncertain tax positions represents amounts that we are contingently liable for based on our tax positions which their respective

statute of limitations ends within 4 to 5 years.

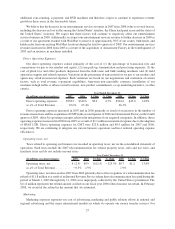

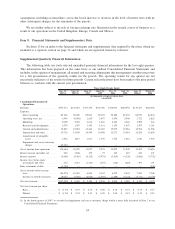

Other Commercial Commitments Total

Less than 1

year

1-3

years

4-5

years

After 5

years

Amount of Commitment Expiration by Period

(In thousands)

Letters of credit .................................... $12,428 $12,428

Total commercial commitments ....................... $12,428 $12,428 $— $— $—

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

We are subject to the risk of fluctuating interest rates in the normal course of business, primarily as a result of

our credit agreement with a syndicate of lenders led by Bank of America, N.A. and investment activities that

generally bear interest at variable rates. Because our investments have maturities of three months or less, and our

credit facility interest rates are based upon either the LIBOR, prime rate or base rate plus an applicable margin, we

believe that the risk of material loss is low and that the carrying amount of these balances approximates fair value.

Based on our outstanding revolving line of credit obligations of $257.0 million as of December 31, 2007, an

increase of 1.0% in interest rates over the next year would increase our annualized interest expense by approx-

imately $2.6 million; a decrease of 1.0% in interest rates over the next year would decrease our annualized interest

expense by approximately $2.6 million. Such potential increases or decreases are based on certain simplified

33