Redbox 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

assumptions, including an immediate, across-the-board increase or decrease in the level of interest rates with no

other subsequent changes for the remainder of the periods.

We are further subject to the risk of foreign exchange rate fluctuation in the normal course of business as a

result of our operations in the United Kingdom, Europe, Canada and Mexico.

Item 8. Financial Statements and Supplementary Data.

See Item 15 for an index to the financial statements and supplementary data required by this item, which are

included as a separate section on page 36 and which are incorporated herein by reference.

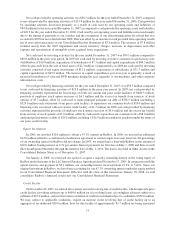

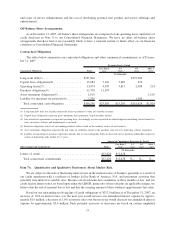

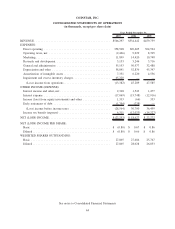

Supplemental Quarterly Financial Information

The following table sets forth selected unaudited quarterly financial information for the last eight quarters.

This information has been prepared on the same basis as our audited Consolidated Financial Statements and

includes, in the opinion of management, all normal and recurring adjustments that management considers necessary

for a fair presentation of the quarterly results for the periods. The operating results for any quarter are not

necessarily indicative of the results for future periods. Certain reclassifications have been made to the prior period

balances to conform with the current year presentation.

Dec. 31,

2007(1)

Sept. 30,

2007(2)

June 30,

2007

March 31,

2007

Dec. 31,

2006

Sept. 30,

2006

June 30,

2006(3)

March 31,

2006

Three Month Periods Ended

(In thousands, except per share data)

(unaudited)

Consolidated Statement of

Operations:

Revenue . .................. $133,314 $143,291 $137,356 $132,336 $138,047 $140,036 $130,327 $126,032

Expenses:

Direct operating ............ 83,166 96,209 89,941 89,192 90,856 88,943 84,932 84,874

Operating taxes, net . . ........ 1,946 (9,488) 2,629 2,447 1,936 2,446 2,722 2,825

Marketing . . . ............. 2,009 5,650 2,614 1,626 5,481 4,626 3,389 924

Research and development . . . . . 1,070 1,397 1,345 1,341 1,155 1,457 1,393 1,241

General and administrative . . . . . 13,857 15,685 13,404 12,247 13,033 13,984 12,594 11,366

Depreciation and other ........ 14,724 15,100 14,549 14,468 13,272 13,410 13,295 12,859

Amortization of intangible

assets ................. 1,962 1,813 1,817 1,739 1,722 1,661 1,510 1,327

Impairment and excess inventory

charges . . . ............. 65,220 — — — — — — —

(Loss) income from operations . . . . (50,640) 16,925 11,057 9,276 10,592 13,509 10,492 10,616

Interest income and other, net . . . . . 292 1,808 173 75 165 487 420 471

Interest expense . ............. (4,605) (4,365) (4,125) (3,974) (3,910) (4,120) (3,986) (3,732)

Income (loss) from equity

investments and other ......... 472 2,217 (1,101) (255) (118) (443) 304 191

Early retirement of debt . ........ (1,794) — — — — — — (238)

(Loss) income before income

taxes . .................. (56,275) 16,585 6,004 5,122 6,729 9,433 7,230 7,308

Income tax benefit (expense) . . . . 19,053 (7,520) (2,656) (2,566) (1,689) (4,144) (3,111) (3,129)

Net (loss) income ............. $(37,222) $ 9,065 $ 3,348 $ 2,556 $ 5,040 $ 5,289 $ 4,119 $ 4,179

Net (loss) income per share:

Basic . .................. $ (1.34) $ 0.33 $ 0.12 $ 0.09 $ 0.18 $ 0.19 $ 0.15 $ 0.15

Diluted .................. $ (1.34) $ 0.32 $ 0.12 $ 0.09 $ 0.18 $ 0.19 $ 0.15 $ 0.15

(1) In the fourth quarter of 2007, we recorded an impairment and excess inventory charge which is more fully described in Note 2 to our

Consolidated Financial Statements.

34