Redbox 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

our variable rate debt under our prior term loan credit facility. The interest rate cap and floor became effective on

October 7, 2004 and expired on October 9, 2007. The interest rate cap and floor consisted of a LIBOR ceiling of

5.18% and a LIBOR floor that stepped up in each of the three years beginning October 7, 2004, 2005 and 2006. The

LIBOR floor rates were 1.85%, 2.25% and 2.75% for each of the respective one-year periods. Under this interest

rate hedge, we continued to pay interest at prevailing rates plus any spread, as defined by our term loan credit

facility, but were reimbursed for any amounts paid on LIBOR in excess of the ceiling. Conversely, we were required

to pay the financial institution that originated the instrument if LIBOR is less than the respective floor rates.

We recognized the fair value of the interest rate cap and floor as an asset of $164,000 at December 31, 2006.

Any change in the fair value of the interest rate cap and floor was reported in accumulated other comprehensive

income. Because the critical terms of the interest rate cap and floor and the underlying obligation were the same,

there was no ineffectiveness recorded in the consolidated statements. In conjunction with the repayment of the term

loan, we no longer hold the interest rate cap and floor as of December 31, 2007.

NOTE 8: COMMITMENTS

Lease commitments: Our corporate administrative, marketing and product development facility is located in

a 46,070 square foot facility in Bellevue, Washington, under a lease that expires December 1, 2009. In connection

with our acquisitions of Amusement Factory and ACMI, we assumed the leases for their respective corporate

headquarters as further discussed Note 17.

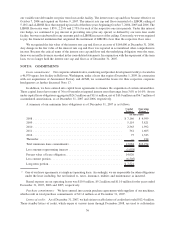

In addition, we have entered into capital lease agreements to finance the acquisition of certain automobiles.

These capital leases have terms of 36 to 60 months at imputed interest rates that range from 3.0% to 16.0%. Assets

under capital lease obligations aggregated $24.5 million and $11.6 million, net of $10.0 million and $6.7 million of

accumulated amortization, as of December 31, 2007 and 2006, respectively.

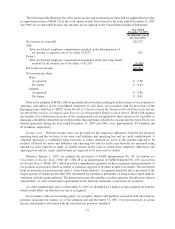

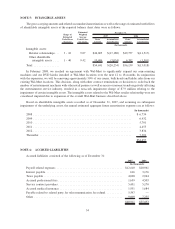

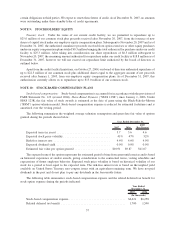

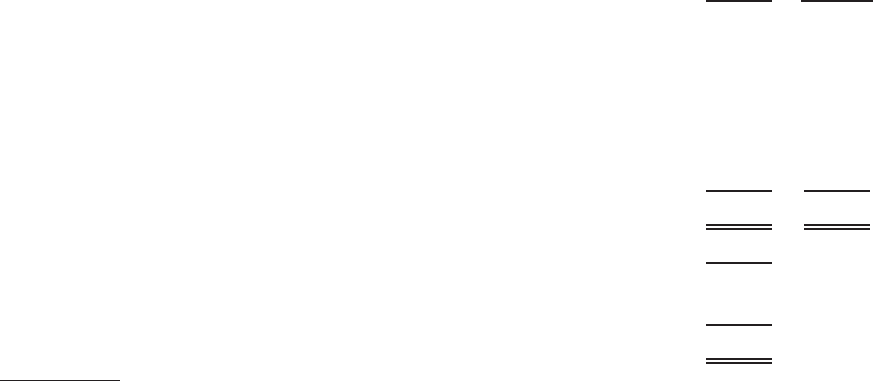

A summary of our minimum lease obligations as of December 31, 2007 is as follows:

Capital

Leases

Operating

Leases *

(In thousands)

2008 ....................................................... $ 7,166 $ 4,959

2009 ....................................................... 5,119 3,821

2010 ....................................................... 2,363 1,992

2011 ....................................................... 361 1,665

2012 ....................................................... 75 1,323

Thereafter ................................................... — 214

Total minimum lease commitments................................. 15,084 $13,974

Less amounts representing interest ................................. (1,058)

Present value of lease obligation. . ................................. 14,026

Less current portion ............................................ (6,505)

Long-term portion ............................................. $ 7,521

* One of our lease agreements is a triple net operating lease. Accordingly, we are responsible for other obligations

under the lease including, but not limited to, taxes, insurance, utilities and maintenance as incurred.

Rental expense on our operating leases was $10.0 million, $9.2 million and $11.0 million for the years ended

December 31, 2007, 2006 and 2005, respectively.

Purchase commitments: We have entered into certain purchase agreements with suppliers of our machines,

which result in total purchase commitments of $11.4 million as of December 31, 2007.

Letters of credit: As of December 31, 2007, we had six irrevocable letters of credit that totaled $12.4 million.

These standby letters of credit, which expire at various times through December 2008, are used to collateralize

56