Redbox 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

inventory in connection with an agreement reached with one of our largest retailers, Wal-Mart. The write-off is

discussed further in the “impairment of long-lived assets” policy note below.

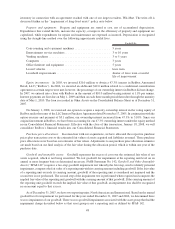

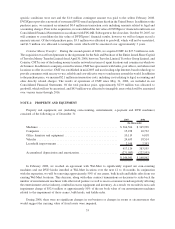

Property and equipment: Property and equipment are stated at cost, net of accumulated depreciation.

Expenditures that extend the life, increase the capacity, or improve the efficiency of property and equipment are

capitalized, while expenditures for repairs and maintenance are expensed as incurred. Depreciation is recognized

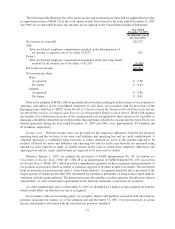

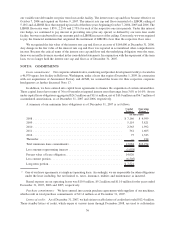

using the straight-line method over the following approximate useful lives.

Useful Life

Coin-counting and e-payment machines ...................... 5years

Entertainment service machines ............................ 3to10years

Vending machines ...................................... 3to5years

Computers ........................................... 3years

Office furniture and equipment ............................ 5years

Leased vehicles........................................ lease term

Leasehold improvements ................................. shorter of lease term or useful

life of improvement

Equity investments: In 2005, we invested $20.0 million to obtain a 47.3% interest in Redbox Automated

Retail, LLC (“Redbox”). In 2006, we invested an additional $12.0 million related to a conditional consideration

agreement as certain targets were met; however, the percentage of our ownership interest in Redbox did not change.

In 2007, we entered into a loan with Redbox in the amount of $10.0 million bearing interest at 11% per annum.

Interest payments are first due on May 1, 2009 and then on each three month period thereafter through the maturity

date of May 1, 2010. The loan is recorded in Other Assets on the Consolidated Balance Sheet as of December 31,

2007.

On January 1, 2008, we exercised our option to acquire a majority ownership interest in the voting equity of

Redbox under the terms of the LLC Interest Purchase Agreement dated November 17, 2005. In conjunction with the

option exercise and payment of $5.1 million, our ownership interest increased from 47.3% to 51.0%. Since our

original investment in Redbox, we have been accounting for our 47.3% ownership interest under the equity method

in our Consolidated Financial Statements. Effective with the close of this transaction, January 18, 2008, we will

consolidate Redbox’s financial results into our Consolidated Financial Statements.

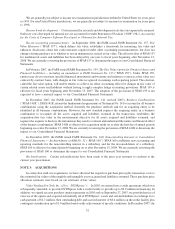

Purchase price allocations: In connection with our acquisitions, we have allocated the respective purchase

prices plus transaction costs to the estimated fair values of assets acquired and liabilities assumed. These purchase

price allocations were based on our estimates of fair values. Adjustments to our purchase price allocation estimates

are made based on our final analysis of the fair value during the allocation period, which is within one year of the

purchase date.

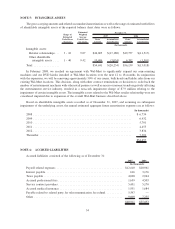

Goodwill and intangible assets: Goodwill represents the excess of cost over the estimated fair value of net

assets acquired, which is not being amortized. We test goodwill for impairment at the reporting unit level on an

annual or more frequent basis as determined necessary. FASB Statement No. 142, Goodwill and Other Intangible

Assets (“SFAS 142”) requires a two-step goodwill impairment test whereby the first step, used to identify potential

impairment, compares the fair value of a reporting unit with its carrying amount including goodwill. If the fair value

of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not impaired and the

second test is not performed. The second step of the impairment test is performed when required and compares the

implied fair value of the reporting unit goodwill with the carrying amount of that goodwill. If the carrying amount of

the reporting unit goodwill exceeds the implied fair value of that goodwill, an impairment loss shall be recognized

in an amount equal to that excess.

As of December 31, 2007, we have two reporting units; North American and International. Based on the annual

goodwill test for impairment we performed for the years ended December 31, 2007 and 2006, we determined there

was no impairment of our goodwill. There was no goodwill impairment associated with the asset group that had the

impairment charge described below as that asset group is not a reporting unit as defined by SFAS 142.

48