Redbox 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

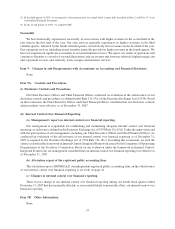

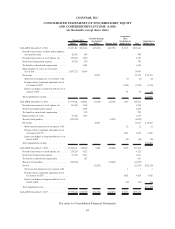

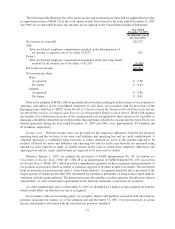

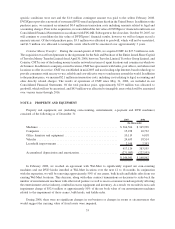

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME (LOSS)

(in thousands, except share data)

Shares Amount

Retained Earnings

(Accumulated

Deficit) Treasury Stock

Accumulated

Other

Comprehensive

Income (Loss) Total

Comprehensive

Income (Loss)

Common Stock

BALANCE, December 31, 2004 . . . .......... 25,227,487 $282,046 $(35,430) $(22,783) $ 2,313 $226,146

Proceeds from issuance of shares under employee

stock purchase plan . . . ............... 82,454 989 989

Proceeds from exercise of stock options, net ..... 323,633 4,559 4,559

Stock-based compensation expense .......... 84,782 340 340

Tax benefit on share-based compensation . ..... 1,048 1,048

Equity purchase of assets, net of issuance

cost of $66 . . . .................... 2,057,272 39,969 39,969

Net income ........................ 22,272 22,272 $ 22,272

Short-term investments net of tax benefit of $4. . (6) (6) (6)

Foreign currency translation adjustments net of

tax benefit of $832 . . ............... (1,324) (1,324) (1,324)

Interest rate hedges on long-term debt net of tax

expense of $35 ................... 54 54 54

Total comprehensive income .............. $ 20,996

BALANCE, December 31, 2005 . . . .......... 27,775,628 328,951 (13,158) (22,783) 1,037 294,047

Proceeds from exercise of stock options, net ..... 310,840 5,368 5,368

Stock-based compensation expense .......... 6,258 6,258

Tax benefit on share-based compensation . ..... 979 979

Equity purchase of assets . ............... 63,468 1,673 1,673

Treasury stock purchase . . ............... (333,925) (8,023) (8,023)

Net income ........................ 18,627 18,627 $ 18,627

Short-term investments net of tax expense of $8. . 12 12 12

Foreign currency translation adjustments net of

tax expense of $732 . ............... 2,482 2,482 2,482

Interest rate hedges on long-term debt net of tax

benefit of $34 .................... (58) (58) (58)

Total comprehensive income .............. $ 21,063

BALANCE, December 31, 2006 . . . .......... 27,816,011 343,229 5,469 (30,806) 3,473 321,365

Proceeds from exercise of stock options, net ..... 218,229 4,232 4,232

Stock-based compensation expense .......... 63,746 6,421 6,421

Tax benefit on share-based compensation . ..... 627 627

Treasury stock purchase . . ............... (358,942) (10,025) (10,025)

Net loss . . ........................ (22,253) (22,253) $(22,253)

Short-term investments net of tax expense of $2. . 1 1 1

Foreign currency translation adjustments net of

tax expense of $205 . ............... 4,828 4,828 4,828

Interest rate hedges on long-term debt net of tax

benefit of $44 .................... (66) (66) (66)

Total comprehensive loss . ............... $(17,490)

BALANCE, December 31, 2007 . . . .......... 27,739,044 $354,509 $(16,784) $(40,831) $ 8,236 $305,130

See notes to Consolidated Financial Statements

45