Redbox 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

these studies, we adjusted the carrying amount of the related deferred tax balances resulting in a charge of

$1.1 million and a benefit of $1.0 million, respectively.

The income tax benefit from stock option exercises in excess of the amounts recognized in the consolidated

statements of operations as of December 31, 2007, 2006 and 2005 that was credited to common stock was

approximately $0.6 million, $1.0 million and $1.0 million, respectively.

NOTE 12: (LOSS) INCOME PER SHARE

Basic net (loss) income per share is computed by dividing the net (loss) income available to common

stockholders for the period by the weighted average number of common shares outstanding during the period.

Diluted net (loss) income per share is computed by dividing the net (loss) income for the period by the weighted

average number of common and potential common shares outstanding (if dilutive) during the period. Potential

common shares, composed of incremental common shares issuable upon the exercise of stock options and warrants,

are included in the calculation of diluted net (loss) income per share to the extent such shares are dilutive.

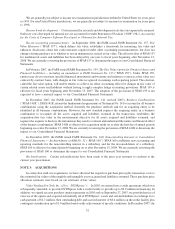

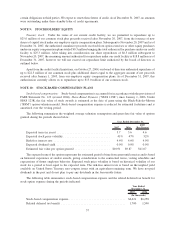

The following table sets forth the computation of basic and diluted net (loss) income per share for the periods

indicated:

2007 2006 2005

Year Ended December 31,

(In thousands)

Numerator:

Net (loss) income ................................... $(22,253) $18,627 $22,272

Denominator:

Weighted average shares for basic calculation .............. 27,805 27,686 25,767

Incremental shares from employee stock options and awards . . . — 342 266

Weighted average shares for diluted calculation ............. 27,805 28,028 26,033

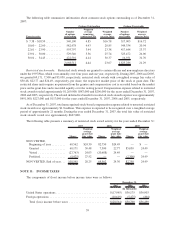

For the years ended December 31, 2007, 2006 and 2005, options and restricted stock awards totaling 779,000,

1.0 million and 1.2 million shares of common stock, respectively, were excluded from the computation of net

income per common share because their impact would be antidilutive.

NOTE 13: RETIREMENT PLAN

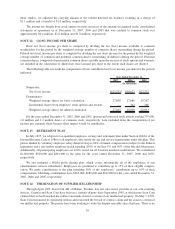

In July 1995, we adopted a tax-qualified employee savings and retirement plan under Section 401(k) of the

Internal Revenue Code of 1986 for all employees who satisfy the age and service requirements under this plan. This

plan is funded by voluntary employee salary deferral of up to 60% of annual compensation (subject to the Federal

limitation) and a safe harbor employer match equaling 100% of the first 3% and 50% of the 4th and 5th percent.

Additionally, all participating employees are 100% vested for all Coinstar matched contributions. We contributed

$1,060,000, $920,000 and $841,000 to the plan for the years ended December 31, 2007, 2006 and 2005,

respectively.

We also maintain a 401(k) profit sharing plan, which covers substantially all of the employees of our

entertainment services subsidiaries. Employees are permitted to contribute up to 15% of their eligible compen-

sation. We make contributions to the plan matching 50% of the employees’ contribution up to 10% of their

compensation. Matching contributions were $661,000, $685,000 and $611,000 for the years ended December 31,

2007, 2006 and 2005, respectively.

NOTE 14: TERMINATION OF SUPPLIER RELATIONSHIP

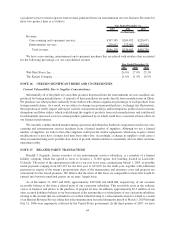

Through April 1999, Scan Coin AB of Malmo, Sweden, was our sole source provider of our coin-counting

devices. Coinstar and Scan Coin have been in a contract dispute since September 1998, at which time Scan Coin

claimed that we had breached the contract and made claims to certain of our intellectual property. On May 5, 1999,

Scan Coin terminated its agreement with us and reasserted the breach of contract claim and the claim to certain of

our intellectual property. The parties have been working to settle the dispute amicably since that time. There is no

62