Redbox 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

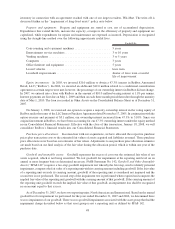

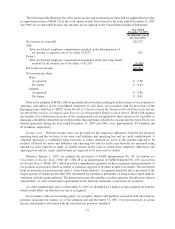

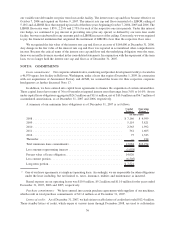

The following table illustrates the effect on net income and net income per share had we applied the fair value

recognition provision of SFAS 123 to the stock option awards. Disclosures for the years ended December 31, 2007

and 2006 are not presented because the amounts are recognized in the Consolidated Financial Statements.

Year Ended

December 31, 2005

(In thousands, except

per share data)

Net income (as reported): ......................................... $22,272

Add:

Total stock-based employee compensation included in the determination of

net income as reported, net of tax effect of $133..................... 207

Deduct:

Total stock-based employee compensation determined under fair value based

method for all awards, net of tax effect of $2,259 .................... (4,588)

Pro forma net income: ............................................ $17,891

Net income per share:

Basic:

As reported:................................................ $ 0.86

Pro forma: ................................................. $ 0.69

Diluted:

As reported:................................................ $ 0.86

Pro forma: ................................................. $ 0.69

Prior to the adoption of SFAS 123R we presented all tax benefits resulting from the exercise of stock options as

operating cash inflows in the consolidated statements of cash flows, in accordance with the provisions of the

Emerging Issues Task Force (“EITF”) Issue No. 00-15, Classification in the Statement of Cash Flows of the Income

Tax Benefit Received by a Company upon Exercise of a Nonqualified Employee Stock Option. SFAS 123R requires

the benefits of tax deductions in excess of the compensation cost recognized for those options to be classified as

financing cash inflows when they are realized rather than operating cash inflows, on a prospective basis. Excess tax

benefits generated during the year ended December 31, 2007 and 2006, were approximately $3.8 million and

$1.0 million, respectively.

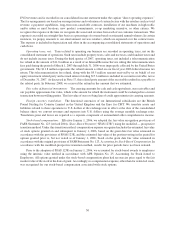

Income taxes: Deferred income taxes are provided for the temporary differences between the financial

reporting basis and the tax basis of our assets and liabilities and operating loss and tax credit carryforwards. A

valuation allowance is established when necessary to reduce deferred tax assets to the amount expected to be

realized. Deferred tax assets and liabilities and operating loss and tax credit carryforwards are measured using

enacted tax rates expected to apply to taxable income in the years in which those temporary differences and

operating loss and tax credit carryforwards are expected to be recovered or settled.

Effective January 1, 2007, we adopted the provisions of FASB Interpretation No. 48, Accounting for

Uncertainty in Income Taxes (“FIN 48”). FIN 48 is an interpretation of FASB Statement No. 109, Accounting

for Income Taxes (“SFAS 109”) which provides comprehensive guidance on the recognition and measurement of

tax positions in previously filed tax returns or positions expected to be taken in future tax returns. The tax benefit

from an uncertain tax position must meet a “more-likely-than-not” recognition threshold and is measured at the

largest amount of benefit greater than 50% determined by cumulative probability of being realized upon ultimate

settlement with the taxing authority. The interpretation provides guidance on derecognition, classification, interest

and penalties, as well as disclosure requirements in the financial statements of uncertain tax positions.

As of the adoption date and as of December 31, 2007 we identified $1.2 million of unrecognized tax benefits

which would affect our effective tax rate if recognized.

In accordance with our accounting policy, we recognize interest and penalties associated with uncertain tax

positions in income tax expense. As of the adoption date and December 31, 2007, it was not necessary to accrue

interest and penalties associated with the uncertain tax positions identified.

51