Redbox 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the fourth quarter of 2006, we recorded $1.6 million of expense for the proposed settlement of a lawsuit

alleging wage and hour violations under the California labor code. The lawsuit was originated primarily from the

employment practices of the acquired entertainment subsidiary prior to the acquisition, of which we made no

admission of liability.

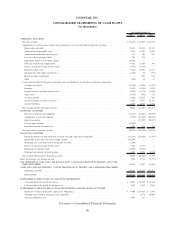

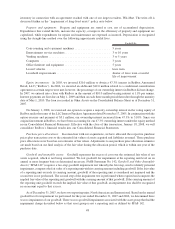

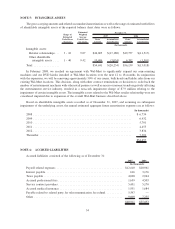

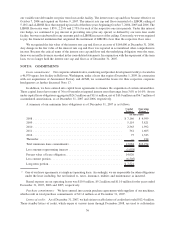

NOTE 7: LONG-TERM DEBT

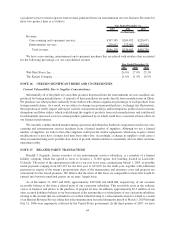

Long-term debt consisted of the following as of December 31:

2007 2006

(In thousands)

Revolving line of credit ........................................ $257,000 $ —

Term loan .................................................. — 186,952

Less current portion .......................................... — (1,917)

Long-term debt .............................................. $257,000 $185,035

Revolving line of credit: On November 20, 2007, we entered into a senior secured revolving line of credit

facility providing advances up to $400.0 million for i) revolving loans, ii) swingline advances subject to a sublimit

of $25.0 million, and iii) to request the issuance of letters of credit in our behalf subject to a sublimit of $50.0 million.

We may, subject to applicable conditions, request an increase in the revolving line of credit facility up to an

aggregate of an additional $50.0 million. Fees for this facility of approximately $1.7 million are being amortized

over the life of the revolving line of credit facility of 5 years. We amortize deferred finance fees on a straight-line

basis which approximates the effective interest method. The credit facility matures on November 20, 2012, at which

time all outstanding borrowings must be repaid and all outstanding letters of credit must have been cash

collateralized. Our obligations under the revolving line of credit facility are secured by a first priority security

interest in substantially all of our assets and the assets of our domestic subsidiaries, as well as a pledge of a

substantial portion of our subsidiaries’ capital stock.

Subject to applicable conditions, we may elect interest rates on our revolving borrowings calculated by

reference to (i) the British Bankers Association LIBOR rate (the “BBA LIBOR Rate”) fixed for given interest

periods or (ii) Bank of America’s prime rate (or, if greater, the average rate on overnight federal funds plus one half

of one percent) (the “Base Rate”), plus a margin determined by our consolidated leverage ratio. For swing line

borrowings, we will pay interest at the Base Rate, plus a margin determined by our consolidated leverage ratio. For

borrowings made with the BBA LIBOR Rate, the margin ranges from 75 to 175 basis points, while for borrowings

made with the Base Rate, the margin ranges from 0 to 50 basis points. As of December 31, 2007, our weighted

average interest rate on the revolving line of credit facility was 6.3%.

The credit facility contains standard negative covenants and restrictions on actions including, without

limitation, restrictions on indebtedness, liens, fundamental changes or dispositions of our assets, payments of

dividends or common stock repurchases, capital expenditures, investments, and mergers, dispositions and acqui-

sitions, among other restrictions. In addition, the credit agreement requires that we meet certain financial covenants,

ratios and tests, including maintaining a maximum consolidated leverage ratio and a minimum interest coverage

ratio, as defined in the agreement. As of December 31, 2007, we were in compliance with all covenants.

Term loan: On July 7, 2004, we entered into a senior secured credit facility. The credit agreement provided

for advances totaling up to $310.0 million, consisting of a $60.0 million revolving credit facility and a $250.0 mil-

lion term loan facility. As of December 31, 2006, no amounts were outstanding under the revolving credit facility

and our original term loan balance of $250.0 million had been reduced to $187.0 million. Fees for this facility of

approximately $5.7 million were being amortized over the life of the revolving line of credit and the term loan

which were 5 years and 7 years, respectively. On November 20, 2007, the outstanding term loan and revolving credit

facility of $229.5 million was paid in full resulting in a charge totaling $1.8 million for the write-off of deferred

financing fees. In 2006, we made a mandatory debt paydown of $16.9 million and recorded $0.2 million

acceleration of deferred finance fees related to this early retirement.

Interest rate hedge: On September 23, 2004, we purchased an interest rate cap and sold an interest rate floor

at zero net cost, which protected us against certain interest rate fluctuations of the LIBOR rate, on $125.0 million of

55