Redbox 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In February 2007, the FASB issued FASB Statement No. 159, The Fair Value Option for Financial Assets and

Financial Liabilities — including an amendment to FASB Statement No. 115 (“SFAS 159”). Under SFAS 159,

entities may elect to measure specified financial instruments and warranty and insurance contracts at fair value on a

contract-by-contract basis, with changes in fair value recognized in earnings each reporting period. The election,

called the fair value option, will enable entities to achieve an offset accounting effect for changes in fair value of

certain related assets and liabilities without having to apply complex hedge accounting provisions. SFAS 159 is

effective for fiscal years beginning after November 15, 2007. The adoption of the provisions of SFAS 159 is not

expected to have a material impact to our Consolidated Financial Statements.

In December 2007, the FASB issued FASB Statement No. 141 (revised 2007), Business Combinations

(“SFAS 141R”). SFAS 141R, retains the fundamental requirements of Statement No. 141 to account for all business

combinations using the acquisition method (formerly the purchase method) and for an acquiring entity to be

identified in all business combinations. However, the new standard requires the acquiring entity in a business

combination to recognize all the assets acquired and liabilities assumed in the transaction; establishes the

acquisition-date fair value as the measurement objective for all assets acquired and liabilities assumed; and

requires the acquirer to disclose the information they need to evaluate and understand the nature and financial effect

of the business combination. SFAS 141R is effective for acquisitions made on or after the first day of annual periods

beginning on or after December 15, 2008. We are currently reviewing the provisions of SFAS 141R to determine the

impact to our Consolidated Financial Statements.

In December 2007, the FASB issued FASB Statement No. 160, Noncontrolling Interests in Consolidated

Financial Statements — An Amendment of ARB No. 51 (“SFAS 160”). SFAS 160 establishes new accounting and

reporting standards for the noncontrolling interest in a subsidiary and for the deconsolidation of a subsidiary.

SFAS 160 is effective for annual periods beginning on or after December 15, 2008. We are currently reviewing the

provisions of SFAS 160 to determine the impact to our Consolidated Financial Statements.

Reclassifications

Certain reclassifications have been made to the prior year amounts to conform to the current year presentation.

Results of Operations — Years Ended December 31, 2007, 2006 and 2005

Revenue

Our coin and e-payment revenues consist primarily of the revenue generated from our coin-counting services

and our e-payments services such as money transfer services, prepaid wireless products, stored value cards and

payroll cards.

Our entertainment revenues consist primarily of the revenues generated from our skill-crane machines, bulk

vending machines and kiddie rides.

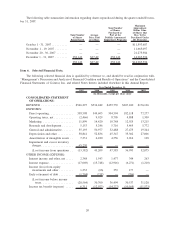

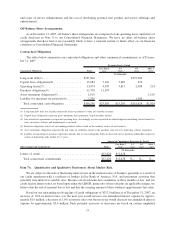

(In millions, except percentages) 2007 2006 $ Chng % Chng 2005 $ Chng % Chng

Year Ended December 31,

Coin and e-payment

revenues .............. $307.4 $261.0 $ 46.4 17.8% $220.7 $40.3 18.3%

Entertainment revenues ..... $238.9 $273.4 $(34.5) ⫺12.6% $239.0 $34.4 14.4%

Total Revenue .......... $546.3 $534.4 $ 11.9 2.2% $459.7 $74.7 16.2%

Our coin and e-payment revenues increased in 2007 from 2006 and in 2006 from 2005 as a result of an increase

in the number of transactions, an increase in the number of installed coin-counting machines, the volume of coins

processed by our coin-counting machines, and as a result of our acquisition of CMT in the second quarter of 2006.

The total dollar value of coins processed through our network increased to approximately $2.9 billion in 2007

from $2.6 billion in 2006 and $2.3 billion in 2005. Additionally, the total coin-counting machines installed as of

December 31, 2007, 2006 and 2005 were approximately 15,400, 13,500 and 12,800, respectively. Revenues for

CMT were $24.2 million and $9.0 million for 2007 and 2006, respectively. We expect to continue installing

26