Redbox 2007 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

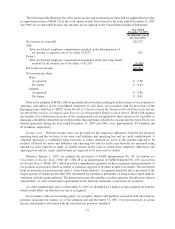

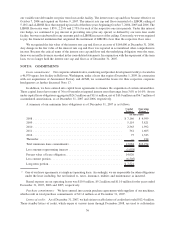

Significant components of our deferred tax assets and liabilities as of December 31, 2007 and 2006 are as

follows:

2007 2006

December 31,

(In thousands)

Deferred tax assets:

Tax loss carryforwards ....................................... $12,030 $26,194

Credit carryforwards ......................................... 4,423 4,076

Accrued liabilities and allowances ............................... 2,638 4,429

Stock compensation ......................................... 2,835 1,654

Inventory ................................................. 832 645

Foreign tax credit ........................................... 1,134 521

Property and equipment ...................................... 12,311 —

Other .................................................... 249 956

Gross deferred tax assets .................................... 36,452 38,475

Less valuation allowance...................................... (2,508) (881)

Total deferred tax assets .................................... 33,944 37,594

Deferred tax liabilities:

Property and equipment ...................................... — (13,212)

Intangible assets ............................................ (11,065) (14,061)

Unremitted earnings ......................................... (3,027) —

Total deferred tax liabilities .................................. (14,092) (27,273)

Net deferred tax asset .......................................... $19,852 $ 10,321

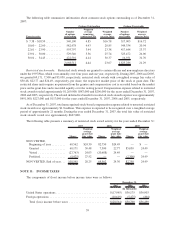

As of December 31, 2007, deferred tax assets included approximately $46.4 million of net operating losses and

United States federal tax credits of $6.0 million. The tax credits consist of $1.1 million of foreign tax credits that

expire from the years 2015 to 2018, $1.6 million of research and development tax credits that expire from the years

2011 to 2028 and $2.8 million of alternative minimum tax credits which do not expire.

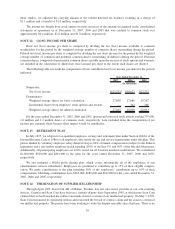

During 2007 adjustments were made to the carrying value of state net operating losses carried forward and

other state deferred tax assets to give effect for certain adjustments to previously calculated amounts as well as

changing apportionment factors, changing tax rates and changes to state income tax laws. On a combined basis state

deferred tax assets were reduced by $1.0 million for these adjustments. Foreign tax assets were further reduced by

$0.2 million to give effect for changes in tax rates and to true-up net operating losses carried forward to actual tax

returns filed.

In May 2006, we acquired CMT and recorded a deferred tax liability of $2.7 million representing acquired

intangibles that had no tax basis. This deferred tax liability is available to realize deferred tax assets related to net

operating loss carryforwards generated by CMT and its subsidiaries, resulting in a lower valuation allowance to

offset that deferred tax asset.

In 2006, the indefinite reversal criteria of Accounting Principle Board Opinion No. 23, Accounting for Income

Taxes — Special Areas (“APB 23”) in which the earnings of our foreign operations are permanently reinvested

outside of the United States was met. As such, United States deferred taxes will not be provided on these earnings.

United States deferred taxes previously recorded on foreign earnings were reversed, which resulted in a $1.5 million

tax benefit in 2006. It is not practible to determine the United States deferred taxes associated with foreign earnings

that are indefinitely reinvested.

During 2006, studies were conducted of accumulated state net operating loss carryforwards and of qualified

research and development expenditures used in computing the research and development tax credit. As a result of

61