Redbox 2007 Annual Report Download - page 26

Download and view the complete annual report

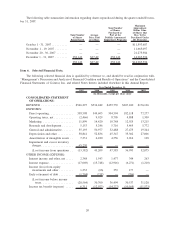

Please find page 26 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Revenue recognition: We recognize revenue as follows:

• Coin-counting revenue is recognized at the time the consumers’ coins are counted by our coin-counting

machines;

• Entertainment services revenue is recognized at the time cash is deposited in our machines. Cash deposited

in the machines that has not yet been collected is referred to as cash in machine and is estimated at period end

and reported on the balance sheet as cash in machine or in transit. This estimate is based on the average daily

revenue per machine multiplied by the number of days since the coin in the machine has been collected. The

estimated value of our entertainment services cash in machine was approximately $8.4 million and

$7.1 million as of December 31, 2007 and 2006, respectively;

• E-payment services revenue is recognized at the point of sale based on our commissions earned, net of

retailer fees. Money transfer revenue is recognized at the time the customer completes the transaction.

Purchase price allocations: In connection with our acquisitions, we have allocated the respective purchase

prices plus transaction costs to the estimated fair values of assets acquired and liabilities assumed. These purchase

price allocations were based on our estimates of fair values. Adjustments to our purchase price allocation estimates

are made based on our final analysis of the fair value during the allocation period, which is within one year of the

purchase date.

Goodwill and intangible assets: Goodwill represents the excess of cost over the estimated fair value of net

assets acquired, which is not being amortized. We test goodwill for impairment at the reporting unit level on an

annual or more frequent basis as determined necessary. FASB Statement No. 142, Goodwill and Other Intangible

Assets (“SFAS 142”) requires a two-step goodwill impairment test whereby the first step, used to identify potential

impairment, compares the fair value of a reporting unit with its carrying amount including goodwill. If the fair value

of a reporting unit exceeds its carrying amount, goodwill of the reporting unit is considered not impaired and the

second test is not performed. The second step of the impairment test is performed when required and compares the

implied fair value of the reporting unit goodwill with the carrying amount of that goodwill. If the carrying amount of

the reporting unit goodwill exceeds the implied fair value of that goodwill, an impairment loss shall be recognized

in an amount equal to that excess.

As of December 31, 2007, we have two reporting units; North American and International. Based on the annual

goodwill test for impairment we performed for the years ended December 31, 2007 and 2006, we determined there

was no impairment of our goodwill. There was no goodwill impairment associated with the asset group that had the

impairment charge described below as that asset group is not a reporting unit as defined by SFAS 142.

Our intangible assets are comprised primarily of retailer relationships acquired in connection with our

acquisitions through the end of 2007. We used expectations of future cash flows to estimate the fair value of the

acquired retailer relationships. We amortize our intangible assets on a straight-line basis over their expected useful

lives which range from 1 to 40 years.

Impairment of long-lived assets: Long-lived assets, such as property and equipment and purchased intan-

gibles subject to amortization, are reviewed for impairment at least annually or whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable. Factors that would indicate

potential impairment include, but are not limited to, significant decreases in the market value of the long-lived

asset(s), a significant change in the long-lived asset’s physical condition and operating or cash flow losses

associated with the use of the long-lived asset. Recoverability of assets to be held and used is measured by a

comparison of the carrying amount of an asset group to the estimated undiscounted future cash flows expected to be

generated by the asset group. If the carrying amount of an asset group exceeds its estimated future cash flows, an

impairment charge is recognized in the amount by which the carrying amount of the asset group exceeds the fair

value of the asset group. While we continue to review and analyze many factors that can impact our business in the

future, our analyses are subjective and are based on conditions existing at, and trends leading up to, the time the

estimates and assumptions are made. Actual results could differ materially from these estimates and assumptions.

Prior to December 31, 2007, Wal-Mart management expressed its intent to reset and optimize its store

entrances. In February 2008, we reached an agreement with Wal-Mart to significantly expand our coin-counting

24