Pottery Barn 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

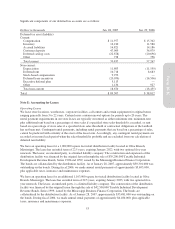

The total expense recognized on all restricted stock units was $6,341,000, $440,000 and zero, during fiscal 2006,

fiscal 2005 and fiscal 2004, respectively. As of January 28, 2007, there was a remaining unamortized balance as

of $23,126,000 (net of estimated forfeitures), which we expect to recognize on a straight-line basis over an

average remaining service period of approximately 3.5 years.

Total Stock-Based Compensation Expense

During fiscal 2006, fiscal 2005 and fiscal 2004, we recognized total stock-based compensation expense, as a

component of selling, general and administrative expense, of $26,759,000, $440,000 and zero ($16,575,000,

$273,000 and zero, net of tax), or approximately $0.14, less than $0.01 and zero per diluted share, respectively.

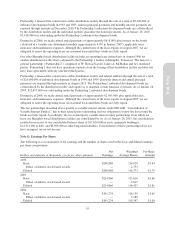

Tax Effect

Prior to the adoption of SFAS No. 123R, we presented all tax benefits resulting from the exercise of stock-based

awards as operating cash flows in the Condensed Consolidated Statements of Cash Flows. SFAS No. 123R

requires that cash flows resulting from tax deductions in excess of the cumulative compensation cost for stock-

based awards exercised be classified as financing cash flows. During fiscal 2006, fiscal 2005 and fiscal 2004,

cash received from stock-based awards exercised was $13,935,000, $28,002,000 and $26,190,000 respectively,

and the tax benefit associated with such exercises totaled $7,696,000, $15,743,000 and $13,085,000,

respectively.

Note J: Williams-Sonoma, Inc. 401(k) Plan and Other Employee Benefits

We have a defined contribution retirement plan, the “Williams-Sonoma, Inc. 401(k) Plan” (the “Plan”), formerly

known as the Williams-Sonoma Associate Stock Incentive Plan, for eligible employees, which is intended to be

qualified under Internal Revenue Code Sections 401(a), 401(k), 401(m) and 4975(e)(7). The Plan permits eligible

employees to make salary deferral contributions up to 15% of eligible compensation each pay period (4% for

certain higher paid individuals through December 2006, 5% thereafter). Employees designate the funds in which

their contributions are invested. Each participant may choose to have his or her salary deferral contributions and

earnings thereon invested in one or more investment funds, including our company stock fund. Our matching

contribution is equal to 50% of each participant’s salary deferral contribution each pay period, taking into

account only those contributions that do not exceed 6% of the participant’s eligible pay for the pay period (4%

for certain higher paid individuals through December 2006, 5% thereafter). For the first five years of the

participant’s employment, all matching contributions generally vest at the rate of 20% per year of service,

measuring service from the participant’s hire date. Thereafter, all matching contributions vest immediately. The

Plan consists of two parts: a profit sharing plan portion and, effective as of April 21, 2006, a stock bonus plan/

employee stock ownership plan (the “ESOP”). The ESOP portion is the portion that is invested in the company

internal revenue stock fund at any time. The profit sharing and ESOP components of the Plan are considered a

single plan under Code section 414(l). Our contributions to the plan were $3,467,000, $3,322,000 and $2,850,000

in fiscal 2006, fiscal 2005 and fiscal 2004, respectively.

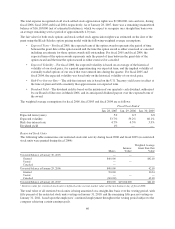

We have a nonqualified executive deferred compensation plan that provides supplemental retirement income

benefits for a select group of management and other certain highly compensated employees. This plan permits

eligible employees to make salary and bonus deferrals that are 100% vested. We have an unsecured obligation to

pay in the future the value of the deferred compensation adjusted to reflect the performance, whether positive or

negative, of selected investment measurement options, chosen by each participant, during the deferral period. As

of January 28, 2007 and January 29, 2006, $13,322,000 and $11,176,000, respectively, was included in other

long-term obligations. Additionally, we have purchased life insurance policies on certain participants to

potentially offset these unsecured obligations. The cash surrender value of these policies was $10,688,000 and

$9,661,000 as of January 28, 2007 and January 29, 2006, respectively, and was included in other assets.

Note K: Financial Guarantees

We are party to a variety of contractual agreements under which we may be obligated to indemnify the other

party for certain matters. These contracts primarily relate to our commercial contracts, operating leases,

trademarks, intellectual property, financial agreements and various other agreements. Under these contracts, we

61

Form 10-K