Pottery Barn 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

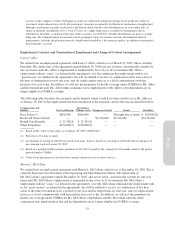

reserves on the company’s books. Participant accounts are adjusted for phantom earnings based on the net returns of

investment funds chosen from a list by the participant. Accounts are generally distributed at termination of employment,

although a participant can make an election at the time of deferral to have the distribution occur at an earlier date. A

choice of quarterly installments over 5, 10 or 15 years, or a single lump sum, is available for terminations due to

retirement or disability, as defined in the plan, if the account is over $25,000. All other distributions are paid as a single

lump sum. The commencement of payments can be postponed, subject to advance election and minimum deferral

requirements. At death, the plan may provide a death benefit funded by a life insurance policy, in addition to payment of

the participant’s account.

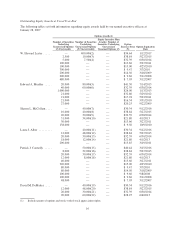

Employment Contracts and Termination of Employment and Change-of-Control Arrangements

Laura J. Alber

We entered into an employment agreement with Laura J. Alber, effective as of March 19, 2001. She is currently

President. The initial term of the agreement expired March 19, 2004 and, per its terms, automatically extends for

one-year terms until Ms. Alber’s employment is terminated by her or by us. If we terminate Ms. Alber’s

employment without “cause” (as defined in the agreement), or if she terminates her employment with us for

“good reason” (as defined in the agreement), she will be entitled to receive (i) continuation of her base salary at

the time of termination for up to one year, and (ii) outplacement services at a level commensurate with her

position at no cost to her. In addition, we will pay the premiums for health coverage under COBRA for Ms. Alber

and her dependents until Ms. Alber either commences new employment or Ms. Alber or her dependents are no

longer eligible for COBRA coverage.

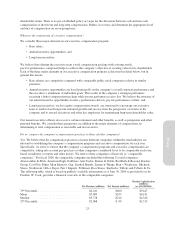

The following table describes the payments and/or benefits which would have been owed by us to Ms. Alber as

of January 28, 2007 if her employment had been terminated in the situations and for the reasons described below.

Compensation and

Benefits For Good Reason

Involuntary

Without Cause Change-in-Control Death Disability

Base Salary(1) ........... $800,000 $800,000 — Through date of death $ 200,000(2)

Restricted Stock Units(3) . . — — $5,136,000 $5,136,000 $5,136,000

Health Care Benefits ...... $ 22,392(4) $ 22,392(4) — — —

Other Perquisites ......... $150,000(5) $150,000(5) — — —

(1) Based on Ms. Alber’s base salary as of January 28, 2007 of $800,000.

(2) Payment of 13 weeks of salary.

(3) Acceleration of vesting of 150,000 restricted stock units. Value is based on a stock price of $34.24, the closing price of

our common stock on January 26, 2007.

(4) Based on a monthly health insurance premium of $1,244 to be paid by the company for 18 months, which is the period

provided under COBRA.

(5) Value of out-placement services based on current estimate of costs for these services.

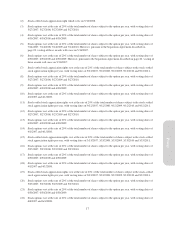

Sharon L. McCollam

We entered into an employment agreement with Sharon L. McCollam, effective as of December 28, 2002. She is

currently Executive Vice President, Chief Operating and Chief Financial Officer. The initial term of

Ms. McCollam’s agreement expired December 28, 2005, and, per its terms, automatically extends for one-year

terms until Ms. McCollam’s employment is terminated by her or by us. If we terminate Ms. McCollam’s

employment without “cause” (as defined in the agreement), or if Ms. McCollam terminates her employment with

us for “good reason” (as defined in the agreement), she will be entitled to receive (i) continuation of her base

salary at the time of termination for a period of one year and her target bonus for that year, and (ii) outplacement

services at a level commensurate with her position at no cost to her. In addition, we will pay the premiums for

health care coverage under COBRA for Ms. McCollam’s dependents and Ms. McCollam until she either

commences new employment or she and her dependents are no longer eligible for COBRA coverage.

19

Proxy