Pottery Barn 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

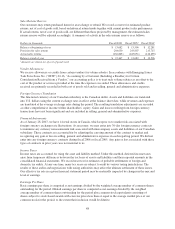

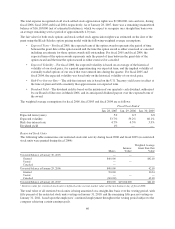

As a result of adopting SFAS No. 123R, during fiscal 2006, our compensation expense recognized was based on

the following:

•Stock Options – Amortization related to the remaining unvested portion of all stock options granted

prior to January 30, 2006 based on the grant date fair value estimated in accordance with the provisions

of SFAS No. 123, as amended by SFAS No. 148, and all stock options granted during fiscal 2006 based

on the grant date fair value estimated in accordance with the provisions of SFAS No. 123R.

•Stock-Settled Stock Appreciation Rights – Amortization of all stock-settled stock appreciation rights

granted during fiscal 2006 based on the grant date fair value estimated in accordance with the provisions

of SFAS No. 123R.

•Restricted Stock Units – Amortization related to the unvested portion of all restricted stock units granted

to date based on the market value of our stock on the date prior to the grant date.

The following tables summarize our stock option, stock-settled stock appreciation right and restricted stock unit

activity during fiscal 2006, fiscal 2005 and fiscal 2004.

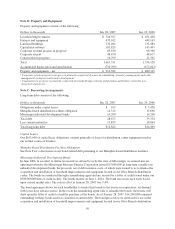

Stock Options

The following table summarizes our stock option activity during fiscal 2006, fiscal 2005 and fiscal 2004:

Shares

Weighted Average

Exercise Price

Weighted Average

Contractual Term

Remaining

(Years) Intrinsic Value1

Balance February 1, 2004 11,779,658 $16.58

Granted (weighted average fair

value of $20.58) 1,626,811 32.57

Exercised (1,817,308) 14.41 $ 35,270,000

Canceled (488,734) 20.81

Balance at January 30, 2005 11,100,427 19.08

Granted (weighted average fair

value of $23.77) 1,754,990 39.07

Exercised (1,829,082) 15.30 $ 42,844,000

Canceled (716,426) 26.81

Balance at January 29, 2006 10,309,909 22.63

Granted (weighted average fair

value of $13.83) 146,700 40.21

Exercised (913,330) 15.26 $ 20,669,000

Canceled (516,990) 33.59

Balance at January 28, 2007 9,026,289 23.04 5.17 $109,551,000

Exercisable at January 30, 2005 5,461,541 $14.26

Exercisable at January 29, 2006 5,704,164 16.00

Exercisable at January 28, 2007 6,624,338 19.02 4.29 $102,640,000

1Intrinsic value is defined as the difference between the grant price and the current market value on the last business day of

fiscal 2006.

58