Pottery Barn 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

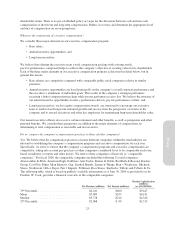

• The vesting schedule of the individual’s outstanding awards;

• The relative value of awards offered by comparable companies to executives in comparable positions; and

• Additional factors, including succession planning and retention of the company’s high potential

executives.

In addition to SSARs, we have also made grants of restricted stock units to certain key executives. The grants of

restricted stock units were designed to act as long-term, performance based, retention tools for key executive

officers. Our grants of restricted stock units to executive officers will vest only if the company achieves certain

earnings goals. Half of the award vests based on achievement of earnings goals over a four-year period, and the

remainder vests based on achievement of earnings goals over a five-year period. The following named executive

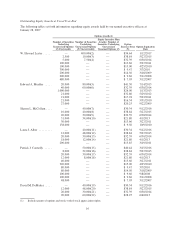

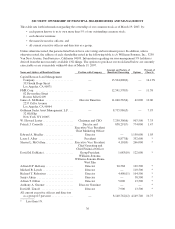

officers held restricted stock units as of January 28, 2007:

RSUs Outstanding Grant Date

Ms. Alber ........................................ 150,000 January 6, 2006

Mr. DeMattei ..................................... 150,000 January 6, 2006

Ms. McCollam .................................... 150,000 January 6, 2006

Although we typically make equity grants to executive officers during the first quarter of our fiscal year as part

of our annual evaluation process, we also grant or approve special additional equity awards from time to time to

executive officers in connection with promotions, assumption of additional responsibilities and other factors.

Ms. Alber, Mr. DeMattei and Ms. McCollam were not awarded additional equity awards during our first quarter

review of compensation, because each had recently been granted restricted stock units as described above.

However, each of these named executive officers was promoted during fiscal 2006, and we approved the

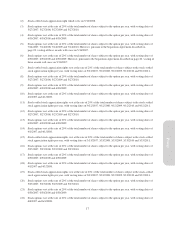

following equity awards at a scheduled Compensation Committee meeting in connection with these promotions:

Date of Award Type of award

Number of Shares

Covered by the Award

Ms. Alber ........................... 9/12/2006 SSAR 40,000

Mr. DeMattei ........................ 9/12/2006 SSAR 40,000

Ms. McCollam ....................... 9/12/2006 SSAR 40,000

Under the company’s existing equity compensation plans, the exercise price of any stock option or SSAR may

not be less than 100% of the fair market value of the stock (based on the price of the company’s common stock

on the date of the award). Equity awards granted pursuant to the company’s equity compensation plans generally

vest in five equal annual installments. It is the company’s policy not to reprice stock options or SSARs in the

event that the fair market value of the common stock falls below the exercise price of the stock options or SSARs

and not to engage in any exchange program relating to stock options or SSARs without obtaining prior

shareholder approval. Our 2001 Long-Term Incentive Plan prohibits such repricings or exchanges unless our

shareholders approve them in advance. We will only make future awards under our 2001 Long-Term Incentive

Plan.

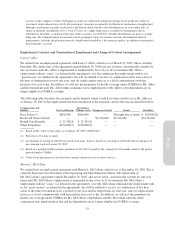

When are equity awards made to executive officers?

Equity awards to executive officers are only made at scheduled Compensation Committee meetings. Executives

do not have any role in selecting the grant date of equity awards. The grant date of equity awards is generally the

date of the approval of the award, and the exercise price is always the closing price of the company’s common

stock on the trading day prior to the grant date. If a Compensation Committee meeting is scheduled for a date

during a company trading blackout period, the grant date of an equity award may be set for a date after the

trading blackout period has ended. As with all awards, the exercise price of these awards is the closing price of

the company’s common stock on the trading day prior to the grant date. In general, equity awards to executives

are made during our March meeting in which we review company performance over the past fiscal year and

determine base salaries and bonuses for all executives. We also make equity awards at other times during the

26