Pottery Barn 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

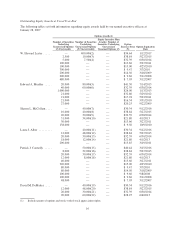

Non-Employee Director Compensation During Fiscal 2006

The following table shows the compensation paid to our non-employee directors during fiscal 2006:

Fees Earned

or Paid in

Cash ($)

Stock

Awards ($)

Option Awards

($)(1)

Non-Stock

Incentive Plan

Compensation

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

All Other

Compensation

($)(9) Total ($)

Sanjiv Ahuja ........ — — $199,740(2) — — $2,323 $202,063

Adrian Bellamy ...... — — $215,720(3) — — $7,784 $223,504

Adrian Dillon ....... — — $205,160(4) — — $7,677 $212,837

Jeanne Jackson ...... — — $ 82,924(5) — — — $ 82,924

Michael Lynch ...... — — $235,621(6) — — $4,316 $239,937

Richard Robertson .... — — $199,740(7) — — $1,636 $201,376

David Zenoff ........ — — $303,568(8) — — $2,797 $306,365

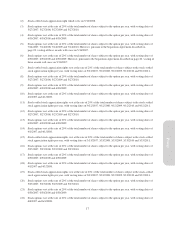

(1) Based on the compensation cost recognized in fiscal 2006 for financial statement reporting purposes as determined

pursuant to Statement of Financial Accounting Standards, or SFAS, No. 123R, disregarding forfeiture assumptions.

Assumptions used in the calculation of these amounts are included in Note I to our Consolidated Financial Statements

which is included in our Annual Report on Form 10-K for the fiscal year ended January 28, 2007.

(2) Fiscal 2006 expense associated with (i) an option award of 12,500 shares of common stock made on May 23, 2006 at an

exercise price of $39.80 per share, with a fair value as of the grant date of $13.64, disregarding forfeiture assumptions

and (ii) an option award of 12,500 shares of common stock made on May 18, 2005 at an exercise price of $36.53 per

share, with a fair value as of the grant date of $22.21, disregarding forfeiture assumptions.

(3) Fiscal 2006 expense associated with (i) an option award of 13,500 shares of common stock made on May 23, 2006 at an

exercise price of $39.80 per share, with a fair value as of the grant date of $13.64, disregarding forfeiture assumptions

and (ii) an option award of 13,500 shares of common stock made on May 18, 2005 at an exercise price of $36.53 per

share, with a fair value as of the grant date of $22.21, disregarding forfeiture assumptions.

(4) Fiscal 2006 expense associated with (i) an option award of 15,500 shares of common stock made on May 23, 2006 at an

exercise price of $39.80 per share, with a fair value as of the grant date of $13.64, disregarding forfeiture assumptions

and (ii) an option award of 13,500 shares of common stock made on April 18, 2005 at an exercise price of $33.66 per

share, with a fair value as of the grant date of $20.64, disregarding forfeiture assumptions.

(5) Fiscal 2006 expense associated with an option award of 12,500 shares of common stock made on May 18, 2005 at an

exercise price of $36.53 per share, with a fair value as of the grant date of $22.21, disregarding forfeiture assumptions.

Ms. Jackson resigned from the Board on October 30, 2006 and her option award made on May 23, 2006 was canceled.

(6) Fiscal 2006 expense associated with (i) an option award of 13,500 shares of common stock made on May 23, 2006 at an

exercise price of $39.80 per share, with a fair value as of the grant date of $13.64, disregarding forfeiture assumptions

and (ii) an option award of 16,500 shares of common stock made on May 18, 2005 at an exercise price of $36.53 per

share, with a fair value as of the grant date of $22.21, disregarding forfeiture assumptions.

(7) Fiscal 2006 expense associated with (i) an option award of 12,500 shares of common stock made on May 23, 2006 at an

exercise price of $39.80 per share, with a fair value as of the grant date of $13.64, disregarding forfeiture assumptions

and (ii) an option award of 12,500 shares of common stock made on May 18, 2005 at an exercise price of $36.53 per

share, with a fair value as of the grant date of $22.21, disregarding forfeiture assumptions.

(8) Fiscal 2006 expense associated with (i) an option award of 12,500 shares of common stock made on May 23, 2006 at an

exercise price of $39.80 per share, with a fair value as of the grant date of $13.64, disregarding forfeiture assumptions

and (ii) an option award of 13,500 shares of common stock made on August 17, 2005 at an exercise price of $41.94 per

share, with a fair value as of the grant date of $25.25, disregarding forfeiture assumptions.

(9) Discount on merchandise.

7

Proxy