Pottery Barn 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

year in connection with promotions, assumption of additional responsibilities and other factors. We do not time

equity grants to take advantage of anticipated or actual changes in the price of our common stock prior to or

following the release of material information regarding the company.

Does the company have a stock ownership policy for its executive officers?

We do not currently have a stock ownership policy for our executive officers, but all of our named executive

officers own shares of the company’s common stock or vested, but unexercised, equity awards.

Does the company have a policy regarding recovery of past awards or payments in the event of a financial

restatement?

Although we do not currently have a formal policy regarding recovery of past awards or payments in the event of

a financial restatement, we support the review of performance-based compensation following a restatement that

impacts the achievement of performance targets relating to that compensation, followed by appropriate action.

These actions may include recoupment of cash or other incentives, as well as employment actions including

termination.

How is the Chief Executive Officer compensated?

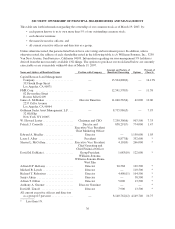

Edward A. Mueller was our Chief Executive Officer until July 14, 2006. The company entered into a separation

agreement with Mr. Mueller on July 9, 2006 pursuant to which Mr. Mueller departed the company as of July 14,

2006 and agreed to not seek or accept nomination as a member of the Board of Directors following the expiration

of his current term that ends as of the company’s 2007 Annual Meeting to be held on May 16, 2007. Pursuant to

this agreement, Mr. Mueller received the following:

• Cash payment of $1,965,625, less applicable withholdings;

• Final salary payment for June 26, 2006 through July 14, 2006 of $56,250;

• Cash payment of $116,250 for unused vacation and floating holidays through July 14, 2006; and

• Continuing administrative and clerical support, including use of company email through February 3,

2008.

In addition, Mr. Mueller received acceleration of vesting of 200,000 unvested stock options due to vest on

January 13, 2007 and acceleration of vesting of 200,000 unvested stock options due to vest on January 13, 2008.

These stock options became fully vested and immediately exercisable on July 14, 2006. All other unvested stock

options will cease vesting as of May 16, 2007.

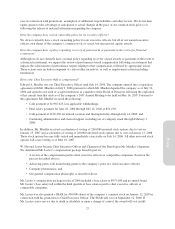

W. Howard Lester became Chief Executive Officer and Chairman of the Board upon Mr. Mueller’s departure.

We determined Mr. Lester’s compensation package based in part on:

• A review of the compensation paid to chief executive officers of comparable companies (based on the

process described above);

• Achieving parity with initial hiring grants to the company’s prior two chief executive officers;

• Company performance; and

• Our general compensation philosophy as described above.

Mr. Lester’s compensation package for fiscal 2006 included a base salary of $975,000 and no annual bonus.

Mr. Lester’s base salary fell within the third quartile of base salaries paid to chief executive officers at

comparable companies.

Mr. Lester was also granted a SSAR for 400,000 shares of the company’s common stock on January 12, 2007 in

connection with his promotion to Chief Executive Officer. The SSAR will vest on September 12, 2008. If

Mr. Lester ceases service due to death or disability or upon a change of control, the award will vest in full.

27

Proxy