Pottery Barn 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

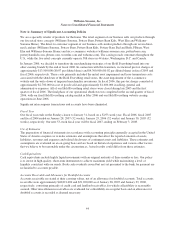

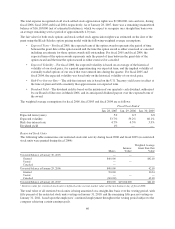

Note D: Income Taxes

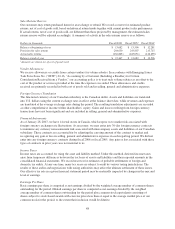

The components of earnings before income taxes, by tax jurisdiction, are as follows:

Fiscal Year Ended

Dollars in thousands Jan. 28, 2007 Jan. 29, 2006 Jan. 30, 2005

United States $ 319,732 $ 337,468 $ 303,986

Foreign 17,454 11,330 6,219

Total earnings before income taxes $ 337,186 $ 348,798 $ 310,205

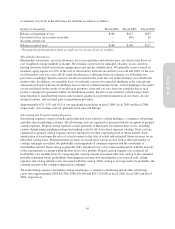

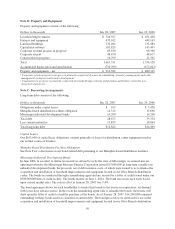

The provision for income taxes consists of the following:

Fiscal Year Ended

Dollars in thousands Jan. 28, 2007 Jan. 29, 2006 Jan. 30, 2005

Current payable

Federal $ 148,125 $ 131,242 $ 105,096

State 24,645 19,002 17,642

Foreign 6,299 4,479 2,487

Total current 179,069 154,723 125,225

Deferred

Federal (44,573) (18,912) (6,168)

State (5,802) (1,538) (70)

Foreign (376) (341) (16)

Total deferred (50,751) (20,791) (6,254)

Total provision $ 128,318 $ 133,932 $ 118,971

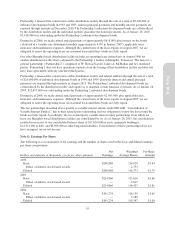

Except where required by U.S. tax law, no provision was made for U.S. income taxes on the cumulative

undistributed earnings of our Canadian subsidiary, as we intend to utilize those earnings in the Canadian

operations for an indefinite period of time and do not intend to repatriate such earnings.

Accumulated undistributed earnings of our Canadian subsidiary were approximately $24,971,000 as of

January 28, 2007. It is currently not practical to estimate the tax liability that might be payable if these foreign

earnings were repatriated.

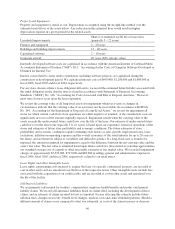

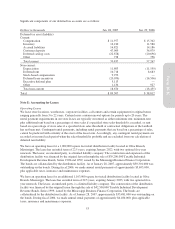

A reconciliation of income taxes at the federal statutory corporate rate to the effective rate is as follows:

Fiscal Year Ended

Jan. 28, 2007 Jan. 29, 2006 Jan. 30, 2005

Federal income taxes at the statutory rate 35.0% 35.0% 35.0%

State income tax rate, less federal benefit 3.1% 3.4% 3.4%

Total 38.1% 38.4% 38.4%

52