Pottery Barn 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

experience, other commitments and the like. We evaluate such factors, among others, and do not assign

any particular weight or priority to any of these factors. We consider each individual candidate in the

context of the current perceived needs of the Board as a whole. While we have not established specific

minimum qualifications for director candidates, we believe that candidates and nominees must reflect a

Board that is comprised of directors (i) a majority of whom are independent; (ii) who are of high

integrity; (iii) who have qualifications that will increase the overall effectiveness of the Board; and

(iv) who meet other requirements as may be required by applicable rules, such as financial literacy or

financial expertise with respect to Audit and Finance Committee members;

• In evaluating and identifying candidates, we have the sole authority to retain and terminate any third party

search firm that is used to identify director candidates and the sole authority to approve the fees and

retention terms of any search firm;

• After such review and consideration, we select, or recommend that the Board select, the slate of director

nominees; and

• We endeavor to notify, or cause to be notified, all director candidates of the decision as to whether to

nominate such individual for election to the Board.

There are no differences in the manner in which the Nominations and Corporate Governance Committee

evaluates nominees for director based on whether the nominee is recommended by a shareholder, management or

a search firm.

How did we perform our responsibilities in fiscal 2006?

The Nominations and Corporate Governance Committee held a total of six meetings during fiscal 2006, and we

took the following actions, among other things:

• Reviewed and discussed with company management applicable changes in corporate governance

requirements under federal and state securities laws and the NYSE listing standards, as well as the

company’s compliance with such requirements;

• Evaluated potential candidates to serve as new independent members of the company’s Board;

• Evaluated the composition of and recommended assignments for the committees of the Board;

• Considered and recommended to the Board the submission to shareholders of the director nominees

described in this Proxy Statement; and

• Reviewed and evaluated the performance of the company’s Chief Executive Officer.

Who prepared this report?

Members of the Nominations and Corporate Governance Committee, Michael R. Lynch, Sanjiv Ahuja,

Adrian D.P. Bellamy and David B. Zenoff, prepared this report.

Audit and Finance Committee Report

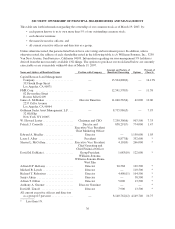

Who serves on the Audit and Finance Committee?

The Audit and Finance Committee consisted of Adrian T. Dillon, Jeanne P. Jackson and Michael R. Lynch from

January 30, 2006 to October 30, 2006. Ms. Jackson resigned from the Audit and Finance Committee on

October 30, 2006, and Richard T. Robertson was appointed to the Audit and Finance Committee on

November 15, 2006. Mr. Dillon qualifies as a “financial expert” under the SEC rules and served as Chairman of

the Audit and Finance Committee during fiscal 2006. The Board has determined that each member of the Audit

and Finance Committee is independent under the NYSE rules, as currently in effect, and Rule 10A-3 of the

Securities Exchange Act of 1934, as amended. The Board has also determined that each Audit and Finance

Committee member is “financially literate,” as described in the NYSE rules.

31

Proxy