Pottery Barn 2006 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

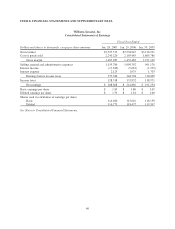

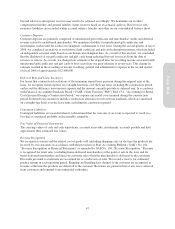

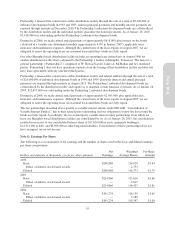

Sales Returns Reserve

Our customers may return purchased items for an exchange or refund. We record a reserve for estimated product

returns, net of cost of goods sold, based on historical return trends together with current product sales performance.

If actual returns, net of cost of goods sold, are different than those projected by management, the estimated sales

returns reserve will be adjusted accordingly. A summary of activity in the sales returns reserve is as follows:

Dollars in thousands Fiscal 20061Fiscal 20051Fiscal 20041

Balance at beginning of year $ 13,682 $ 13,506 $ 12,281

Provision for sales returns 264,630 243,807 215,715

Actual sales returns (262,845) (243,631) (214,490)

Balance at end of year $ 15,467 $ 13,682 $ 13,506

1Amounts are shown net of cost of goods sold.

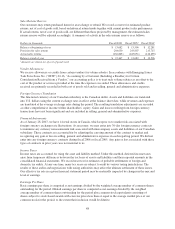

Vendor Allowances

We receive allowances or credits from certain vendors for volume rebates. In accordance with Emerging Issues

Task Force Issue No. (“EITF”) 02-16, “Accounting by a Customer (Including a Reseller) for Certain

Consideration Received from a Vendor,” our accounting policy is to treat such volume rebates as an offset to the

cost of the product or services provided at the time the expense is recorded. These allowances and credits

received are primarily recorded in both cost of goods sold and in selling, general and administrative expenses.

Foreign Currency Translation

The functional currency of our Canadian subsidiary is the Canadian dollar. Assets and liabilities are translated

into U.S. dollars using the current exchange rates in effect at the balance sheet date, while revenues and expenses

are translated at the average exchange rates during the period. The resulting translation adjustments are recorded

as other comprehensive income within shareholders’ equity. Gains and losses resulting from foreign currency

transactions have not been significant and are included in selling, general and administrative expenses.

Financial Instruments

As of January 28, 2007, we have 14 retail stores in Canada, which expose us to market risk associated with

foreign currency exchange rate fluctuations. As necessary, we may enter into 30-day foreign currency contracts

to minimize any currency remeasurement risk associated with intercompany assets and liabilities of our Canadian

subsidiary. These contracts are accounted for by adjusting the carrying amount of the contract to market and

recognizing any gain or loss in selling, general and administrative expenses in each reporting period. We did not

enter into any foreign currency contracts during fiscal 2006 or fiscal 2005. Any gain or loss associated with these

types of contracts in prior years was not material to us.

Income Taxes

Income taxes are accounted for using the asset and liability method. Under this method, deferred income taxes

arise from temporary differences between the tax basis of assets and liabilities and their reported amounts in the

consolidated financial statements. We record reserves for estimates of probable settlements of foreign and

domestic tax audits. At any one time, many tax years are subject to audit by various taxing jurisdictions. The

results of these audits and negotiations with taxing authorities may affect the ultimate settlement of these issues.

Our effective tax rate in a given financial statement period may be materially impacted by changes in the mix and

level of earnings.

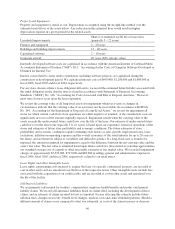

Earnings Per Share

Basic earnings per share is computed as net earnings divided by the weighted average number of common shares

outstanding for the period. Diluted earnings per share is computed as net earnings divided by the weighted

average number of common shares outstanding for the period plus common stock equivalents consisting of

shares subject to stock-based awards with exercise prices less than or equal to the average market price of our

common stock for the period, to the extent their inclusion would be dilutive.

48