Pottery Barn 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

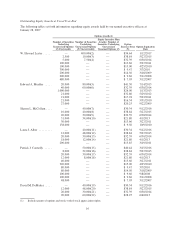

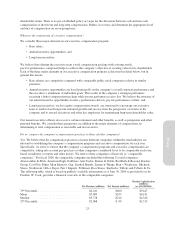

The following table describes the payments and/or benefits which would have been owed by us to Ms. McCollam as

of January 28, 2007 if her employment had been terminated in the situations and for the reasons described below.

Compensation and

Benefits For Good Reason

Involuntary

Without Cause Change-in-Control Death Disability

Base Salary(1) ........... $ 725,000 $ 725,000 — Through date of death $ 181,250(2)

Bonus(3) ............... $1,560,000 $1,560,000 — — —

Restricted Stock Units(4) . . — — $5,136,000 $5,136,000 $5,136,000

Health Care Benefits ...... $ 7,704(5) $ 7,704(5) — — —

Other Perquisites ......... $ 150,000(6) $ 150,000(6) — — —

(1) Based on Ms. McCollam’s base salary as of January 28, 2007 of $725,000.

(2) Payment of 13 weeks of salary.

(3) Maximum bonus payable under the 2001 Incentive Bonus Plan for fiscal 2006. See “Grants of Plan Based Awards” table

on page 15.

(4) Acceleration of vesting of 150,000 restricted stock units. Value is based on a stock price of $34.24, the closing price of

our common stock on January 26, 2007.

(5) Based on a monthly health insurance premium of $428 to be paid by the company for 18 months, which is the period

provided under COBRA.

(6) Value of out-placement services based on current estimate of costs for these services.

Edward A. Mueller

Edward A. Mueller was our Chief Executive Officer until July 14, 2006. We entered into a separation agreement

with Mr. Mueller on July 9, 2006 pursuant to which Mr. Mueller departed as of July 14, 2006 and agreed to not

seek or accept nomination as a member of the Board of Directors following the expiration of his current term that

ends as of our 2007 Annual Meeting. Pursuant to this agreement, Mr. Mueller received the following:

• Cash payment of $1,965,625, less applicable withholdings;

• Final salary payment for June 26, 2006 through July 14, 2006 of $56,250;

• Cash payment of $116,250 for unused vacation and floating holidays through July 14, 2006; and

• Continuing administrative and clerical support, including use of our email through February 3, 2008.

In addition, Mr. Mueller received acceleration of vesting of 200,000 unvested stock options due to vest on

January 13, 2007 and acceleration of vesting of 200,000 unvested stock options due to vest on January 13, 2008.

These stock options became fully vested and immediately exercisable on July 14, 2006. All other unvested stock

options will cease vesting as of May 16, 2007.

Restricted Stock Unit Grants

Laura Alber, Sharon McCollam and David DeMattei received restricted stock unit grants in fiscal 2005, as

specified in the Summary Compensation Table. Each of these executives will receive accelerated vesting of such

awards in the event of a change of control. These executive officers will also have such awards vest in full upon a

termination due to their death, disability or retirement after attaining age 55 and working with us or our

subsidiaries for at least 10 years. Based on a stock price of $34.24, the closing price of our common stock on

January 26, 2007, each of these awards has an estimated value of $5,136,000.

W. Howard Lester SSAR Award

Mr. Lester was granted a stock-settled stock appreciation right, or SSAR, for 400,000 shares of the company’s

common stock on January 12, 2007 in connection with his appointment as Chief Executive Officer. The SSAR

will vest on September 12, 2008. If Mr. Lester ceases service due to death or disability or upon a change of

control, the award will vest in full.

20