Pottery Barn 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The bond agreement allows for each bondholder to tender their bonds to the trustee for repurchase, on demand,

with seven days advance notice. In the event the remarketing agent fails to remarket the bonds, the trustee will

draw upon the letter of credit to fund the purchase of the bonds. As of January 28, 2007, $14,200,000 remained

outstanding on these bonds and was classified as current debt. The bond proceeds were restricted for use in the

acquisition and installation of leasehold improvements and equipment located in our Olive Branch distribution

center. As of January 28, 2007, we had acquired and installed all $15,000,000 of leasehold improvements and

equipment associated with the facility.

Capital Leases

Our $163,000 of capital lease obligations consists primarily of leases for distribution center equipment used in

our normal course of business.

Other Contractual Obligations

We have other liabilities reflected in our consolidated balance sheets. The payment obligations associated with

these liabilities are not reflected in the table above due to the absence of scheduled maturities. The timing of

these payments cannot be determined, except for amounts estimated to be payable in fiscal 2007 which are

included in our current liabilities as of January 28, 2007.

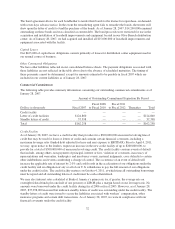

Commercial Commitments

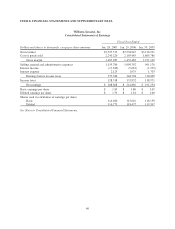

The following table provides summary information concerning our outstanding commercial commitments as of

January 28, 2007.

Amount of Outstanding Commitment Expiration By Period

Dollars in thousands Fiscal 2007

Fiscal 2008

to Fiscal 2010

Fiscal 2011

to Fiscal 2012 Thereafter Total

Credit facility — — — — —

Letter of credit facilities $124,860 — — — $124,860

Standby letters of credit 37,398 — — — 37,398

Total $162,258 — — — $162,258

Credit Facility

As of January 28, 2007, we have a credit facility that provides for a $300,000,000 unsecured revolving line of

credit that may be used for loans or letters of credit and contains certain financial covenants, including a

maximum leverage ratio (funded debt adjusted for lease and rent expense to EBITDAR). Prior to April 4, 2011,

we may, upon notice to the lenders, request an increase in the new credit facility of up to $200,000,000, to

provide for a total of $500,000,000 of unsecured revolving credit. The credit facility contains events of default

that include, among others, non-payment of principal, interest or fees, violation of covenants, inaccuracy of

representations and warranties, bankruptcy and insolvency events, material judgments, cross defaults to certain

other indebtedness and events constituting a change of control. The occurrence of an event of default will

increase the applicable rate of interest by 2.0% and could result in the acceleration of our obligations under the

credit facility and an obligation of any or all of our U.S. subsidiaries to pay the full amount of our obligations

under the credit facility. The credit facility matures on October 4, 2011, at which time all outstanding borrowings

must be repaid and all outstanding letters of credit must be cash collateralized.

We may elect interest rates calculated at Bank of America’s prime rate (or, if greater, the average rate on

overnight federal funds plus one-half of one percent) or LIBOR plus a margin based on our leverage ratio. No

amounts were borrowed under the credit facility during fiscal 2006 or fiscal 2005. However, as of January 28,

2007, $37,398,000 in issued but undrawn standby letters of credit was outstanding under the credit facility. The

standby letters of credit were issued to secure the liabilities associated with workers’ compensation, other

insurance programs and certain debt transactions. As of January 28, 2007, we were in compliance with our

financial covenants under the credit facility.

32