Pottery Barn 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

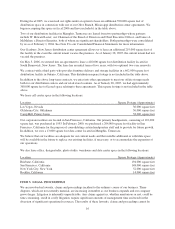

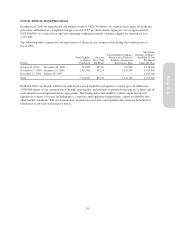

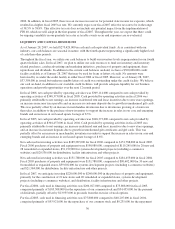

ITEM 6. SELECTED FINANCIAL DATA

Five-Year Selected Financial Data

Dollars and amounts in thousands, except percentages,

per share amounts and retail stores data Jan. 28, 2007 Jan. 29, 2006 Jan. 30, 2005 Feb. 1, 2004 Feb. 2, 2003

Results of Operations

Net revenues $3,727,513 $3,538,947 $3,136,931 $2,754,368 $2,360,830

Net revenue growth 5.3% 12.8% 13.9% 16.7% 13.1%

Gross margin $1,487,287 $1,435,482 $1,271,145 $1,110,577 $ 951,601

Earnings before income taxes $ 337,186 $ 348,798 $ 310,205 $ 255,638 $ 202,282

Net earnings $ 208,868 $ 214,866 $ 191,234 $ 157,211 $ 124,403

Basic net earnings per share $ 1.83 $ 1.86 $ 1.65 $ 1.36 $ 1.08

Diluted net earnings per share $ 1.79 $ 1.81 $ 1.60 $ 1.32 $ 1.04

Gross margin as a percent of net revenues 39.9% 40.6% 40.5% 40.3% 40.3%

Pre-tax operating margin as a percent of net revenues19.0% 9.9% 9.9% 9.3% 8.6%

Financial Position

Working capital $ 473,229 $ 492,772 $ 351,608 $ 245,005 $ 200,556

Total assets $2,048,331 $1,981,620 $1,745,545 $1,470,735 $1,264,455

Return on assets 10.1% 11.4% 11.9% 11.5% 11.0%

Long-term debt and other long-term obligations $ 32,562 $ 29,201 $ 32,476 $ 38,358 $ 23,217

Shareholders’ equity $1,151,431 $1,125,318 $ 957,662 $ 804,591 $ 643,978

Shareholders’ equity per share (book value) $ 10.48 $ 9.80 $ 8.30 $ 6.95 $ 5.63

Return on equity 18.3% 20.6% 21.7% 21.7% 21.1%

Debt-to-equity ratio 2.5% 3.0% 4.4% 4.6% 4.0%

Annual dividends declared per share $ 0.40 — — — —

Retail Revenues

Retail revenue growth 6.0% 12.3% 11.6% 13.9% 15.1%

Retail revenues as a percent of net revenues 57.8% 57.4% 57.7% 58.9% 60.3%

Comparable store sales growth 0.3% 4.9% 3.5% 4.0% 2.7%

Store count

Williams-Sonoma: 254 254 254 237 236

Grande Cuisine 248 243 238 215 204

Classic 611162232

Pottery Barn: 197 188 183 174 159

Design Studio 197 188 181 168 153

Classic —— 266

Pottery Barn Kids 92 89 87 78 56

West Elm 22 12 4 1 —

Williams-Sonoma Home 7 3 — — —

Outlets 16 16 15 14 14

Hold Everything — 8 9 8 13

Number of stores at year-end 588 570 552 512 478

Store selling area at fiscal year-end (sq. ft.) 3,389,000 3,140,000 2,911,000 2,624,000 2,356,000

Store leased area at fiscal year-end (sq. ft.) 5,451,000 5,035,000 4,637,000 4,163,000 3,725,000

Direct-to-Customer Revenues

Direct-to-customer revenue growth 4.5% 13.6% 17.1% 20.8% 10.2%

Direct-to-customer revenues as a percent of net revenues 42.2% 42.6% 42.3% 41.1% 39.7%

Catalogs circulated during the year 379,011 385,158 368,210 328,355 279,724

Percent (decrease) increase in number of catalogs

circulated (1.6%) 4.6% 12.1% 17.4% 14.1%

Percent increase in number of pages circulated 3.2% 9.7% 19.5% 16.8% 16.1%

1Pre-tax operating margin is defined as earnings before income taxes.

The information set forth above is not necessarily indicative of future operations and should be read in

conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and

the Consolidated Financial Statements and notes thereto in this Annual Report on Form 10-K.

20