Pottery Barn 2006 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

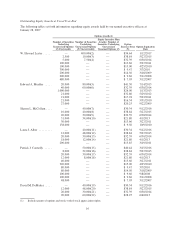

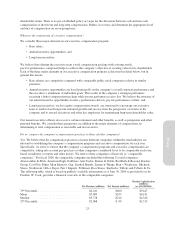

Other Annual Compensation from Summary Compensation Table

The following table sets forth the compensation and benefits included under “All Other Compensation” in the

Summary Compensation table above.

Year

Use of

Company

Aircraft(1)

Life

Insurance

Premiums(2)

Matching

Contribution

to the 401(k)(3)

Car

Allowance

Executive

Medical

Supplement Parking(4) Other

W. Howard Lester ........... 2006 $346,575 $5,334 $4,500 $6,000 $1,591 $2,400 —

Edward A. Mueller ........... 2006 — $ 798 — $3,000 — $1,200 $2,082,875(5)

Sharon L. McCollam ......... 2006 — $ 420 $4,500 $6,000 $2,500 $2,400 $ 45,000(6)

Laura J. Alber ............... 2006 — $ 378 $4,500 $6,000 $ 525 $2,400 $ 45,000(6)

Patrick J. Connolly ........... 2006 — $1,632 $4,500 $6,000 $1,899 $2,400 —

David M. DeMattei ........... 2006 — $ 575 $4,500 $6,000 $ 734 $2,400 $ 45,000(6)

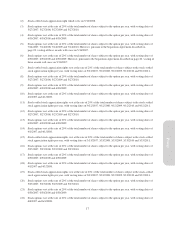

(1) For personal use of our airplane. The value of personal aircraft usage reported above for fiscal 2006 is the aggregate

incremental cost to the company (including fuel, maintenance and certain fees and expenses) as determined and

published from time to time by Conklin & de Decker Associates, Inc. for each particular aircraft type utilized by the

company.

(2) Premiums paid by us for term life insurance in excess of $50,000.

(3) Represents the approximate maximum company matching contribution to the 401(k) during fiscal 2006.

(4) Represents the approximate value of parking provided by the company, based on current estimated market rates.

(5) Amounts paid in connection with the separation agreement entered into between us and Mr. Mueller on July 9, 2006

including: (i) a termination payment of $1,965,625, (ii) $116,250 in accrued but unused vacation time and floating

holidays, and (iii) administrative and clerical support valued at approximately $1,000, based on the amount of time

spent on administrative matters for Mr. Mueller.

(6) Dividend equivalent payments made with respect to outstanding restricted stock unit awards.

14