Pottery Barn 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

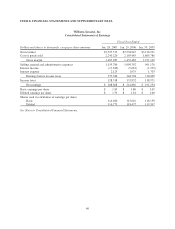

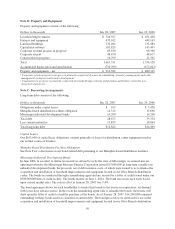

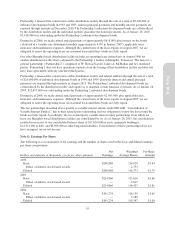

Note B: Property and Equipment

Property and equipment consists of the following:

Dollars in thousands Jan. 28, 2007 Jan. 29, 2006

Leasehold improvements $ 720,927 $ 651,498

Fixtures and equipment 479,012 449,163

Land and buildings 132,464 131,484

Capitalized software 181,829 145,407

Corporate systems projects in progress183,650 98,398

Corporate aircraft 48,670 48,677

Construction in progress216,799 31,501

Total 1,663,351 1,556,128

Accumulated depreciation and amortization (750,769) (675,823)

Property and equipment – net $ 912,582 $ 880,305

1Corporate systems projects in progress is primarily comprised of a new merchandising, inventory management and order

management system currently under development.

2Construction in progress is primarily comprised of leasehold improvements and furniture and fixtures related to new,

unopened retail stores.

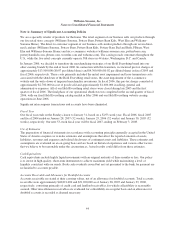

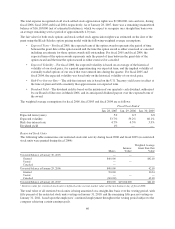

Note C: Borrowing Arrangements

Long-term debt consists of the following:

Dollars in thousands Jan. 28, 2007 Jan. 29, 2006

Obligations under capital leases $ 163 $ 3,458

Memphis-based distribution facilities obligation 14,312 15,696

Mississippi industrial development bonds 14,200 14,200

Total debt 28,675 33,354

Less current maturities 15,853 18,864

Total long-term debt $12,822 $14,490

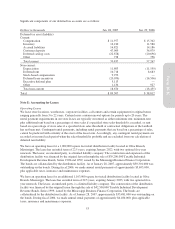

Capital Leases

Our $163,000 of capital lease obligations consists primarily of leases for distribution center equipment used in

our normal course of business.

Memphis-Based Distribution Facilities Obligation

See Note F for a discussion on our bond-related debt pertaining to our Memphis-based distribution facilities.

Mississippi Industrial Development Bonds

In June 2004, in an effort to utilize tax incentives offered to us by the state of Mississippi, we entered into an

agreement whereby the Mississippi Business Finance Corporation issued $15,000,000 in long-term variable rate

industrial development bonds, the proceeds, net of debt issuance costs, of which were loaned to us to finance the

acquisition and installation of leasehold improvements and equipment located in our Olive Branch distribution

center. The bonds are marketed through a remarketing agent and are secured by a letter of credit issued under our

$300,000,000 line of credit facility. The bonds mature on June 1, 2024. The bond rate resets each week based

upon current market rates. The rate in effect at January 28, 2007 was 5.4%.

The bond agreement allows for each bondholder to tender their bonds to the trustee for repurchase, on demand,

with seven days advance notice. In the event the remarketing agent fails to remarket the bonds, the trustee will

draw upon the letter of credit to fund the purchase of the bonds. As of January 28, 2007, $14,200,000 remained

outstanding on these bonds and was classified as current debt. The bond proceeds were restricted for use in the

acquisition and installation of leasehold improvements and equipment located in our Olive Branch distribution

50