Pottery Barn 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

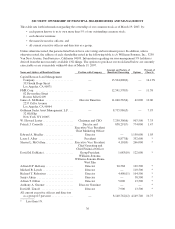

(1) Assumes exercise of stock options currently exercisable or exercisable within 60 days of March 19, 2007 by

the named individual or entity into shares of our common stock. Based on 110,161,426 shares outstanding

as of March 19, 2007.

(2) The information above and in this footnote is based on information taken from the Schedule 13G jointly

filed by each of Capital Research and Management Company and AMCAP Fund, Inc. with the Securities

and Exchange Commission on February 9, 2007. Capital Research and Management Company has sole

voting power over 10,959,800 shares of our common stock and sole dispositive power over 15,564,800

shares of our common stock. AMCAP Fund, Inc., which is advised by Capital Research and Management

Company, is the beneficial owner of 6,000,000 shares of our common stock (included in the aggregate

15,564,800 shares identified above).

(3) The information above and in this footnote is based on information taken from the Schedule 13G of FMR

Corp., filed with the Securities and Exchange Commission on February 12, 2007. FMR Corp. has sole

voting power over 237,770 shares of our common stock. In addition, FMR Corp. is a parent holding

company as defined under Rule 13d-1(b)(ii)(G) of the Securities and Exchange Act of 1934, as amended,

and accordingly is deemed the beneficial owner with sole dispositive power over 12,541,570 shares of our

common stock beneficially owned through multiple entities to which it is a direct or indirect parent.

Edward C. Johnson 3rd, as chairman of FMR Corp., has sole dispositive power over 12,541,570 shares of

our common stock, and members of the Johnson family, directly or through trusts, may be deemed, under

the Investment Company Act of 1940, to form a controlling group with respect to FMR Corp.

(4) The information above and in this footnote is based on information taken from the Schedule 13G filed by

James A. McMahan filed with the Securities and Exchange Commission on February 7, 2007.

(5) The information above and in this footnote is based on information taken from the Schedule 13G of

Goldman Sachs Asset Management, L.P., filed with the Securities and Exchange Commission on

February 8, 2007. Goldman Sachs Asset Management, L.P. has sole voting power over 7,599,099 shares of

our common stock and sole dispositive power over 8,735,986 shares of our common stock.

(6) Mr. Lester owns $2,861 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of March 19,

2007. The number of shares listed above includes 81 shares held in the Williams-Sonoma, Inc. Stock Fund.

This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock Fund by

$35.30, the closing price of Williams-Sonoma, Inc. common stock on March 19, 2007.

(7) Mr. Connolly owns $958,769 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of

March 19, 2007. The number of shares listed above includes 27,161 shares held in the Williams-Sonoma,

Inc. Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc.

Stock Fund by $35.30, the closing price of Williams-Sonoma, Inc. common stock on March 19, 2007.

(8) Ms. Alber owns $242,754 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of March 19,

2007. The number of shares listed above includes 6,877 shares held in the Williams-Sonoma, Inc. Stock

Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock Fund

by $35.30, the closing price of Williams-Sonoma, Inc. common stock on March 19, 2007.

(9) Ms. McCollam owns $130,665 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of

March 19, 2007. The number of shares listed above includes 3,701 shares held in the Williams-Sonoma, Inc.

Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock

Fund by $35.30, the closing price of Williams-Sonoma, Inc. common stock on March 19, 2007.

(10) Mr. DeMattei owns $38,246 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan, as of

March 19, 2007. The number of shares listed above includes 1,084 shares held in the Williams-Sonoma, Inc.

Stock Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock

Fund by $35.30, the closing price of Williams-Sonoma, Inc. common stock on March 19, 2007.

(11) Includes 4,400 shares owned by Mr. Robertson’s wife.

(12) The directors and officers as a group own $1,381,605 in the Williams-Sonoma, Inc. Stock Fund under our

401(k) plan, as of March 19, 2007. The number of shares listed above includes 39,139 shares held in the

Williams-Sonoma, Inc. Stock Fund. This number was calculated by dividing the amount owned in the

Williams-Sonoma, Inc. Stock Fund by $35.30, the closing price of Williams-Sonoma, Inc. common stock on

March 19, 2007. Of the 39,139 shares, 143 are unvested and will fully vest by June 4, 2008.

37

Proxy