Pottery Barn 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

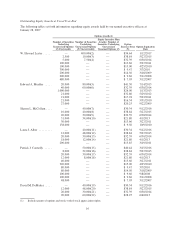

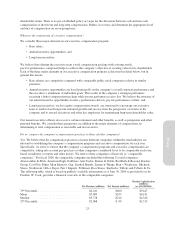

Stock Awards

Number of Shares or

Units of Stock that

have not Vested (#)

Market Value of

Shares or Units of

Stock that have

not Vested ($)

Equity Incentive Plan

Awards: Number of

Unearned Shares, Units or

Other Rights that have

not Vested (#)(1)

Equity Incentive

Plan Awards:

Market or Payout Value of

Unearned Shares, Units

or Other Rights that have

not Vested ($)(2)

W. Howard Lester ......... — — — —

Edward A. Mueller ......... — — — —

Sharon L. McCollam ....... — — 150,000 $5,136,000

Laura J. Alber ............. — — 150,000 $5,136,000

Patrick J. Connolly ......... — — — —

David M. DeMattei ......... — — 150,000 $5,136,000

(1) Includes grants of restricted stock units. The restricted stock units vest in two equal annual installments on January 31,

2010 and January 31, 2011, subject to the company achieving certain performance goals. Our named executive officers

will receive accelerated vesting of any restricted stock units held by them in the event of a change of control. These

executive officers will also have such awards vest in full upon a termination due to their death, disability or retirement

after attaining age 55 and working with us or our subsidiaries for at least 10 years.

(2) Based on a stock price of $34.24, the closing price of our common stock on January 26, 2007.

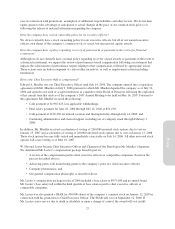

Option Exercises and Stock Vested

The following table sets forth information regarding exercises and vesting of equity awards held by our named

executive officers during fiscal 2006:

Option Awards Stock Awards

Number of Shares

Acquired on Exercise (#)

Value Realized on

Exercise ($)

Number of Shares

Acquired on Vesting (#)

Value Realized

on Vesting ($)

W. Howard Lester ............ 120,000 $3,699,000 — —

Edward A. Mueller ........... — — — —

Sharon L. McCollam .......... — — — —

Laura J. Alber ............... 75,000 $2,353,236 — —

Patrick J. Connolly ........... 32,000 $ 989,280 — —

David M. DeMattei ........... — — — —

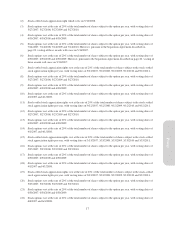

Pension Benefits

None of our named executive officers received any pension benefits during fiscal 2006.

Nonqualified Deferred Compensation

The following table describes nonqualified deferred compensation to our named executive officers during fiscal

2006:

Executive

Contributions in

Fiscal 2006 ($)

Registrant

Contributions in

Fiscal 2006 ($)

Aggregate

Earnings in

Fiscal 2006 ($)

Aggregate

Withdrawals/

Distributions ($)

Aggregate Balance at

January 28, 2007 ($)

W. Howard Lester(1) ..... — — $23,094 — $468,291

Edward A. Mueller ....... — — — — —

Sharon L. McCollam ..... — — — — —

Laura J. Alber ........... — — — — —

Patrick J. Connolly ....... — — — — —

David M. DeMattei ...... — — — — —

(1) Executive Deferral Plan. Participation in the plan is limited to a group of select management and highly compensated

employees. Participants can defer up to 100% of their base salary and/or bonus, net of applicable employment and

withholding taxes and subject to a minimum deferral requirement (5% of salary). Participant accounts are unfunded

18