Pottery Barn 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

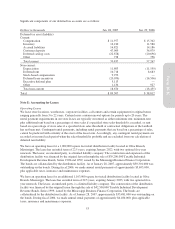

In December 2003, we entered into an agreement to lease 780,000 square feet of a distribution facility located in

Olive Branch, Mississippi. The lease has an initial term of six years, with two optional two-year renewals. The

agreement includes an option to lease an additional 390,000 square feet of the same distribution center. We

exercised this option and began occupying this space in fiscal 2006. During fiscal 2006, we made annual rental

payments of approximately $2,968,000, plus applicable taxes, insurance and maintenance expenses.

In February 2004, we entered into an agreement to lease 781,000 square feet of a distribution center located in

Cranbury, New Jersey. The lease has an initial term of seven years, with three optional five-year renewals. The

agreement allows us to lease an additional 219,000 square feet of the facility in the event the current tenant

vacates the premises. As of January 28, 2007, the current tenant had not vacated the premises. During fiscal

2006, we made annual rental payments of approximately $3,397,000, plus applicable taxes, insurance and

maintenance expenses.

In August 2004, we entered into an agreement to lease a 500,000 square foot distribution facility located in

Memphis, Tennessee. The lease has an initial term of four years, with one optional three-year and nine-month

renewal. During fiscal 2006, we made annual rental payments of approximately $1,025,000, plus applicable

taxes, insurance and maintenance expenses.

In May 2006, we entered into an agreement to lease a 418,000 square foot distribution facility located in South

Brunswick, New Jersey. The lease has an initial term of two years, with two optional two-year renewals. During

fiscal 2006, we made annual rental payments of approximately $1,247,000, plus applicable taxes, insurance and

maintenance expenses.

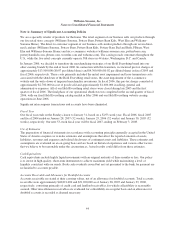

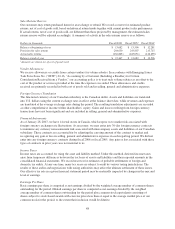

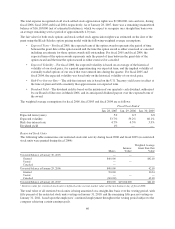

Total rental expense for all operating leases was as follows:

Fiscal Year Ended

Dollars in thousands Jan. 28, 2007 Jan. 29, 2006 Jan. 30, 2005

Minimum rent expense $130,870 $119,440 $110,618

Contingent rent expense 35,020 33,529 26,724

Less: sublease rental income (39) (62) (59)

Total rent expense $165,851 $152,907 $137,283

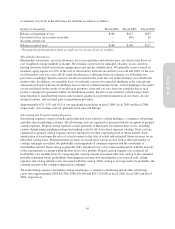

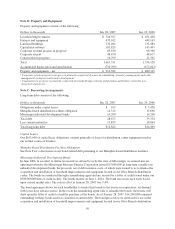

The aggregate minimum annual rental payments under noncancelable operating leases (excluding the Memphis-

based distribution facilities) in effect at January 28, 2007 were as follows:

Dollars in thousands

Minimum Lease

Commitments1

Fiscal 2007 $ 191,638

Fiscal 2008 186,959

Fiscal 2009 179,484

Fiscal 2010 168,498

Fiscal 2011 151,921

Thereafter 713,042

Total $ 1,591,542

1Projected payments include only those amounts that are fixed and determinable as of the reporting date. We currently pay

rent for certain store locations based on a percentage of store sales if a specified store sales threshold or contractual

obligations of the landlord have not been met. Projected payments for these locations are based on minimum rent, as future

store sales cannot be predicted with certainty.

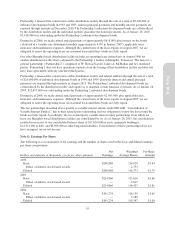

Note F: Consolidation of Memphis-Based Distribution Facilities

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of W. Howard

Lester, our Chairman of the Board of Directors and Chief Executive Officer and James A. McMahan, a Director

Emeritus, both of whom are significant shareholders. Partnership 1 does not have operations separate from the

leasing of this distribution facility and does not have lease agreements with any unrelated third parties.

54