Pottery Barn 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

“option awards”), restricted stock awards, restricted stock units and deferred stock awards (collectively, “stock

awards”) up to an aggregate of 8,500,000 shares.

In May 2006, our shareholders approved the amendment and restatement of our 2001 Plan to permit us to grant

dividend equivalents, increase the shares issuable under the Plan by 6,000,000 shares and to include in the 2001

Plan shares that remained available under the 1993 Plan and 2000 Plan, as well as shares subject to outstanding

stock options under these plans that subsequently expire unexercised, for an aggregate maximum total of

15,959,903 shares under the 2001 Plan. The 1993 Plan and the 2000 Plan will no longer be used to grant future

awards. Awards may be granted under the 2001 Plan to officers, employees and non-employee Board members

of the company or any parent or subsidiary. Annual grants are limited to 1,000,000 shares covered by option

awards and 400,000 shares covered by stock awards on a per person basis. All grants of option awards made

under the 2001 Plan have a maximum term of ten years, except incentive stock options that may be issued to 10%

shareholders, which have a maximum term of five years. The exercise price of these option awards is not less

than 100% of the closing price of our stock on the date prior to the grant date or not less than 110% of such

closing price for an incentive stock option granted to a 10% shareholder. Option awards granted to employees

generally vest over five years. Option awards granted to non-employee Board members generally vest in one

year. Non-employee Board members automatically receive option awards on the date of their initial election to

the Board and annually thereafter on the date of the annual meeting of shareholders (so long as they continue to

serve as a non-employee Board member). Shares issued as a result of option award exercises will be funded with

the issuance of new shares. Stock awards granted after May 2006 have a minimum vesting period of three years

for service based awards and one year for performance based awards. However, exceptions to the minimum

vesting requirements may occur in the event of a merger or similar corporate event. As of January 28, 2007, there

were 6,746,000 shares available for future grant.

Effective January 30, 2006, we adopted SFAS No. 123R, which requires us to measure and record compensation

expense in our consolidated financial statements for all employee stock-based awards using a fair value method.

Accordingly, at the beginning of fiscal 2006, we began recording compensation expense for all stock-based

awards under the modified prospective transition method.

Prior to January 30, 2006, we accounted for stock-based compensation arrangements using the intrinsic value

method in accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to

Employees” and related interpretations. Accordingly, no compensation expense was recognized prior to fiscal

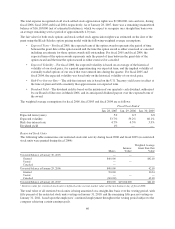

2006 for option awards with an exercise price equal to the fair value on the date of grant. The following table

illustrates the effect on net earnings and earnings per share as if we had applied the fair value recognition

provisions of SFAS No. 123, as amended by SFAS No. 148, to all of our stock-based compensation arrangements

during fiscal 2005 and fiscal 2004:

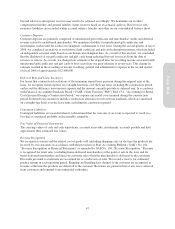

Fiscal Year Ended

Dollars in thousands, except per share amounts Jan. 29, 2006 Jan. 30, 2005

Net earnings, as reported $214,866 $191,234

Add: stock-based employee compensation expense included in reported net

earnings, net of related tax effect 273 —

Less: total stock-based employee compensation expense determined under fair

value method for all awards, net of related tax effect (16,788) (17,059)

Pro forma net earnings $198,351 $174,175

Basic earnings per share

As reported $ 1.86 $ 1.65

Pro forma 1.72 1.50

Diluted earnings per share

As reported $ 1.81 $ 1.60

Pro forma 1.69 1.47

57

Form 10-K