Pottery Barn 2006 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In PBteen, increased revenues were driven by revitalized catalog marketing and innovative product introductions,

both of which are long-term success factors for the brand.

In Williams-Sonoma Home, fiscal 2006 was a challenging year, particularly since it was the first year the brand

began operating in all three shopping channels: retail, catalog, and e-commerce. During the year, the reach of the

brand was extended by opening four new stores and launching an e-commerce website. Despite these growth

initiatives, results for the year fell well below our expectations. These results were impacted by brand-building

operational issues that are taking longer to implement than initially planned, in addition to the asset impairment

charges recorded on two stores during fiscal 2006 due to expected future cash flows falling below the current net

book value of the stores. Both of these were mid-market stores that were opened in fiscal 2005.

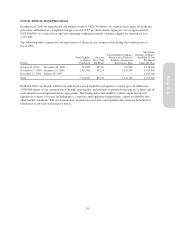

In January 2006, we decided to transition the merchandising strategies of our Hold Everything brand into our

other existing brands by the end of fiscal 2006. In connection with this transition, we incurred pre-tax charges of

approximately $13,500,000 ($0.07 per diluted share) and $4,300,000 ($0.02 per diluted share) in fiscal 2005 and

fiscal 2006, respectively. These costs primarily included the initial asset impairment and lease termination costs

associated with the shutdown of the Hold Everything retail stores, the asset impairment of the e-commerce

website and the write-down of impaired merchandise inventories. In fiscal 2006, this pre-tax charge consisted of

approximately $2,700,000 in cost of goods sold and approximately $1,600,000 in selling, general and

administrative expenses. All of our Hold Everything retail stores were closed during late 2005 and the first

quarter of fiscal 2006. The final phase of our operational shutdown was completed in the second quarter of fiscal

2006, with our final Hold Everything catalog mailed in May 2006 and our Hold Everything website ceasing

operations in June 2006.

Fiscal 2006 Operational Results

In supply chain operations, we successfully in-sourced our east coast furniture hub operations, which allowed us

to improve the furniture delivery experience for our customers and reduce our furniture return rates. We also

implemented regional warehousing for our high-volume east coast stores, expanded our capabilities in

monogramming and personalization, re-engineered our direct-to-customer returns processing operations and

expanded our distribution network by increasing distribution leased square footage by 7.2%.

In information technology, we implemented new retail inventory management systems in our Williams-Sonoma

and Pottery Barn Kids brands. We believe that over time these new systems will allow us to optimize the flow of

inventory from our vendors to our stores, as well as improve our service levels to our customers. We also

implemented new gift card issuance and redemption functionality in our direct-to-customer channel. We believe

that this functionality is critical to driving future growth as consumers increasingly show a preference for this

convenient form of gift giving. To support the long-term scalability of our infrastructure, we also continued to

invest in the custom development of our new direct-to-customer order management and inventory management

systems. All of these initiatives enhanced our operational infrastructure and leave us well positioned to support

accelerated growth in the coming years.

Fiscal 2007

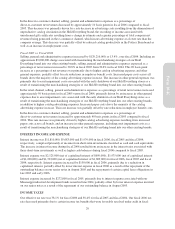

In fiscal 2007, we will focus on the strategic initiatives that can transform the financial performance of the

company over the next several years: driving sustainable revenue growth with a key focus on the revitalization of

the Pottery Barn brand; increasing our pre-tax operating margin by continuing to drive operational advancements

and cost containment initiatives across the company; and enhancing shareholder value.

To drive sustainable revenue growth in fiscal 2007, we expect to add 13 net new stores and expand or remodel an

additional 20 stores. We also expect to increase catalog circulation and electronic direct marketing and plan to

intensify the marketing support behind our fastest growing shopping channel, e-commerce. As a result of our

initiatives in the emerging brands (West Elm, PBteen and Williams-Sonoma Home) in fiscal 2007, we expect

these brands to represent a more significant portion of our growth than in prior years. In West Elm, we will round

out our merchandise assortment in core categories and expand to every room of the home. We will also open five

22