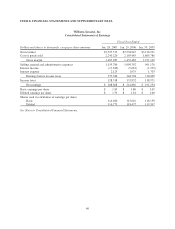

Pottery Barn 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Williams-Sonoma, Inc.

Notes to Consolidated Financial Statements

Note A: Summary of Significant Accounting Policies

We are a specialty retailer of products for the home. The retail segment of our business sells our products through

our five retail store concepts (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, West Elm and Williams-

Sonoma Home). The direct-to-customer segment of our business sells similar products through our seven direct-

mail catalogs (Williams-Sonoma, Pottery Barn, Pottery Barn Kids, Pottery Barn Bed and Bath, PBteen, West

Elm and Williams-Sonoma Home) and six e-commerce websites (williams-sonoma.com, potterybarn.com,

potterybarnkids.com, pbteen.com, westelm.com and wshome.com). The catalogs reach customers throughout the

U.S., while the five retail concepts currently operate 588 stores in 44 states, Washington, D.C. and Canada.

In January 2006, we decided to transition the merchandising strategies of our Hold Everything brand into our

other existing brands by the end of fiscal 2006. In connection with this transition, we incurred pre-tax charges of

approximately $13,500,000 ($0.07 per diluted share) and $4,300,000 ($0.02 per diluted share) in fiscal 2005 and

fiscal 2006, respectively. These costs primarily included the initial asset impairment and lease termination costs

associated with the shutdown of the Hold Everything retail stores, the asset impairment of the e-commerce

website and the write-down of impaired merchandise inventories. In fiscal 2006, this pre-tax charge consisted of

approximately $2,700,000 in cost of goods sold and approximately $1,600,000 in selling, general and

administrative expenses. All of our Hold Everything retail stores were closed during late 2005 and the first

quarter of fiscal 2006. The final phase of our operational shutdown was completed in the second quarter of fiscal

2006, with our final Hold Everything catalog mailed in May 2006 and our Hold Everything website ceasing

operations in June 2006.

Significant intercompany transactions and accounts have been eliminated.

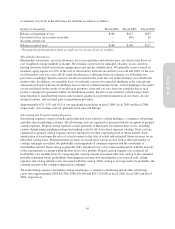

Fiscal Year

Our fiscal year ends on the Sunday closest to January 31, based on a 52/53-week year. Fiscal 2006, fiscal 2005

and fiscal 2004 ended on January 28, 2007 (52 weeks), January 29, 2006 (52 weeks) and January 30, 2005 (52

weeks), respectively. Our next 53-week fiscal year will be fiscal 2007, ending on February 3, 2008.

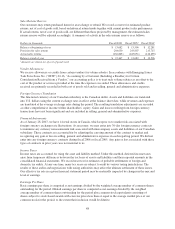

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United

States of America requires us to make estimates and assumptions that affect the reported amounts of assets,

liabilities, revenues and expenses and related disclosures of contingent assets and liabilities. These estimates and

assumptions are evaluated on an on-going basis and are based on historical experience and various other factors

that we believe to be reasonable under the circumstances. Actual results could differ from these estimates.

Cash Equivalents

Cash equivalents include highly liquid investments with an original maturity of three months or less. Our policy

is to invest in high-quality, short-term instruments to achieve maximum yield while maintaining a level of

liquidity consistent with our needs. Book cash overdrafts issued but not yet presented to the bank for payment are

reclassified to accounts payable.

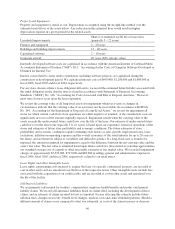

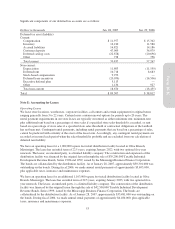

Accounts Receivable and Allowance for Doubtful Accounts

Accounts receivable are stated at their carrying values, net of an allowance for doubtful accounts. Total accounts

receivable were approximately $48,821,000 and $51,020,000 as of January 28, 2007 and January 29, 2006,

respectively, consisting primarily of credit card and landlord receivables, for which collectibility is reasonably

assured. Other miscellaneous receivables are evaluated for collectibility on a regular basis and an allowance for

doubtful accounts is recorded as deemed necessary.

44