Panera Bread 2014 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

68

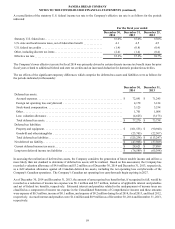

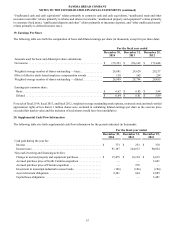

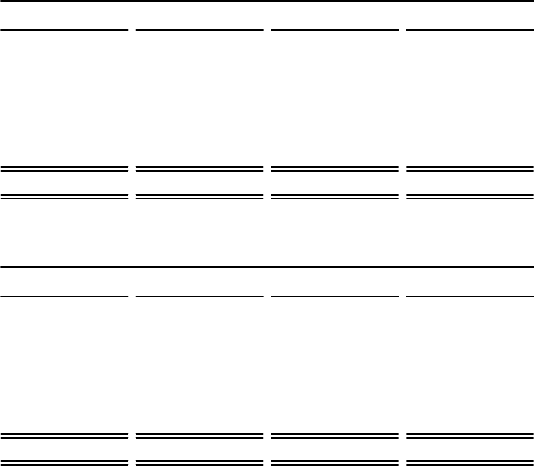

21. Selected Quarterly Financial Data (unaudited)

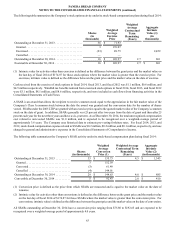

The following table presents selected unaudited quarterly financial data for the periods indicated (in thousands, except per share

data):

Fiscal 2014 - quarters ended (1)

April 1 July 1 September 30 December 30

Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 605,753 $ 631,055 $ 619,890 $ 672,497

Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67,005 73,942 57,959 77,037

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42,395 49,192 39,214 48,492

Earnings per common share:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.55 $ 1.83 $ 1.47 $ 1.82

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.55 $ 1.82 $ 1.46 $ 1.82

Fiscal 2013 - quarters ended (1)

March 26 June 25 September 24 December 31

Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 561,779 $ 589,011 $ 572,480 $ 661,732

Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76,305 83,435 64,569 85,447

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48,117 51,042 42,762 54,248

Earnings per common share:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.65 $ 1.75 $ 1.49 $ 1.97

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.64 $ 1.74 $ 1.48 $ 1.96

(1) Fiscal quarters may not sum to the fiscal year reported amounts due to rounding.

The fiscal year ended December 31, 2013 had 53 weeks. As a result, the quarterly financial data for the fiscal fourth quarter 2013

reflects 14 weeks.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

None.

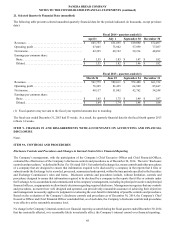

ITEM 9A. CONTROLS AND PROCEDURES

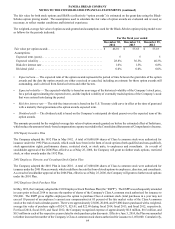

Disclosure Controls and Procedures and Changes in Internal Control Over Financial Reporting

The Company’s management, with the participation of the Company’s Chief Executive Officer and Chief Financial Officer,

evaluated the effectiveness of the Company’s disclosure controls and procedures as of December 30, 2014. The term “disclosure

controls and procedures,” as defined in Rules 13a-15(e) and 15d-15(e) under the Exchange Act, means controls and other procedures

of a company that are designed to ensure that information required to be disclosed by a company in the reports that it files or

submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities

and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and

procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under

the Exchange Act is accumulated and communicated to the company’s management, including its principal executive and principal

financial officers, as appropriate to allow timely decisions regarding required disclosure. Management recognizes that any controls

and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving their objectives

and management necessarily applies its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Based on the evaluation of the Company’s disclosure controls and procedures as of December 30, 2014, the Company’s Chief

Executive Officer and Chief Financial Officer concluded that, as of such date, the Company’s disclosure controls and procedures

were effective at the reasonable assurance level.

No change in the Company’s internal control over financial reporting occurred during the fiscal quarter ended December 30, 2014

that has materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting.