Panera Bread 2014 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

50

expense for new locations is charged to expense beginning on the date at which the Company has the right to control the use of

the property. Many of the Company's lease agreements also contain provisions that require additional rental payments based upon

net bakery-cafe sales volume, which the Company refers to as contingent rent. Contingent rent is accrued each period as the

liability is incurred, in addition to the straight-line rent expense noted above. This results in variability in occupancy expense over

the term of the lease in bakery-cafes where the Company pays contingent rent.

The Company records landlord allowances and incentives received as deferred rent in the Consolidated Balance Sheets based on

their short-term or long-term nature. This deferred rent is amortized on a straight-line basis over the reasonably assured lease

term as a reduction of rent expense. Additionally, payments made by the Company and reimbursed by the landlord for improvements

deemed to be lessor assets have no impact on the Statements of Comprehensive Income. The Company considers improvements

to be a lessor asset if all of the following criteria are met:

• the lease specifically requires the lessee to make the improvement;

• the improvement is fairly generic;

• the improvement increases the fair value of the property to the lessor; and

• the useful life of the improvement is longer than the lease term.

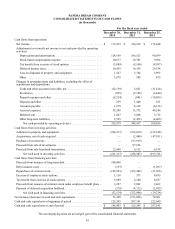

The Company reports the period to period change in the landlord receivable within the operating activities section of its Consolidated

Statements of Cash Flows.

Earnings Per Share

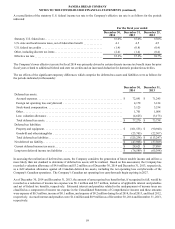

Basic earnings per share is computed by dividing net income by the weighted-average number of shares of common stock

outstanding during the fiscal year. Diluted earnings per common share is computed by dividing net income by the weighted-

average number of shares of common stock outstanding and dilutive securities outstanding during the year.

Foreign Currency Translation

The Company has nine Company-owned bakery-cafes, one Company-owned fresh dough facility, and six franchise-operated

bakery-cafes in Canada which use the Canadian Dollar as their functional currency. Assets and liabilities are translated into U.S.

dollars using the current exchange rate in effect at the balance sheet date, while revenues and expenses are translated at the weighted-

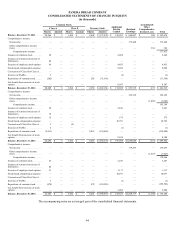

average exchange rate during the fiscal period. The resulting translation adjustments are recorded as a separate component of

accumulated other comprehensive income in the Consolidated Balance Sheets and Consolidated Statements of Changes in Equity.

Gains and losses resulting from foreign currency transactions have not historically been significant and are included in other

(income) expense, net in the Consolidated Statements of Comprehensive Income.

Fair Value of Financial Instruments

The carrying amounts of cash, accounts receivable, accounts payable, and other accrued expenses approximate their fair values

due to the short-term nature of these assets and liabilities.

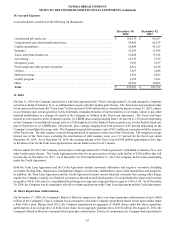

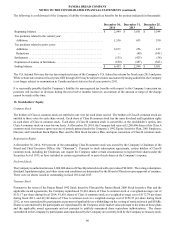

Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with the accounting standard for stock-based compensation,

which requires the Company to measure and record compensation expense in the Company’s consolidated financial statements

for all stock-based compensation awards using a fair value method. The Company maintains several stock-based incentive plans

under which the Company may grant incentive stock options, non-statutory stock options and stock settled appreciation rights

(collectively, “option awards”) and restricted stock and restricted stock units to certain directors, officers, employees and

consultants. The Company also offers a stock purchase plan where employees may purchase the Company’s common stock each

calendar quarter through payroll deductions at 85 percent of market value on the purchase date and the Company recognizes

compensation expense on the 15 percent discount.

For option awards, fair value is determined using the Black-Scholes option pricing model, while restricted stock is valued using

the closing stock price on the date of grant. The Black-Scholes option pricing model requires the input of subjective assumptions.

These assumptions include estimating the expected term until the option awards are either exercised or canceled, the expected

volatility of the Company’s stock price, for a period approximating the expected term, the risk-free interest rate with a maturity

that approximates the option awards expected term, and the dividend yield based on the Company’s anticipated dividend payout

over the expected term of the option awards. These assumptions are evaluated and revised, as necessary, to reflect market conditions