Panera Bread 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

2012, we repurchased 34,600 shares under the 2009 repurchase authorization at an average price of $144.24 per share for an

aggregate purchase price of $5.0 million. On August 23, 2012, our Board of Directors terminated the 2009 repurchase authorization.

Prior to its termination, we had repurchased a total of 2,844,669 shares of our Class A common stock cumulatively under the 2009

repurchase authorization at a weighted-average price of $87.03 per share for an aggregate purchase price of approximately $247.6

million.

On August 23, 2012, our Board of Directors approved a three year share repurchase authorization of up to $600 million of our

Class A common stock, pursuant to which we repurchased shares on the open market under a Rule 10b5-1 plan. During fiscal

2014, we repurchased 514,357 shares under the 2012 repurchase authorization, at an average price of $170.15 per share, for an

aggregate purchase price of $87.5 million. During fiscal 2013 we purchased 1,992,250 shares under the 2012 repurchase

authorization, at an average price of $166.73 per share, for an aggregate purchase price of $332.1 million. During fiscal 2012,

we repurchased 124,100 shares under the 2012 repurchase authorization, at an average price of $161.00 per share, for an aggregate

purchase price of approximately $20.0 million. On June 5, 2014, our Board of Directors terminated this repurchase authorization.

Prior to its termination, we had repurchased a total of 2,630,707 shares of our Class A common stock cumulatively under the 2012

repurchase authorization at a weighted-average price of $167.13 per share for an aggregate purchase price of approximately $439.7

million.

On June 5, 2014, our Board of Directors approved a new three year share repurchase authorization of up to $600 million of our

Class A common stock, which we refer to as the 2014 repurchase authorization, pursuant to which we may repurchase shares from

time to time on the open market or in privately negotiated transactions and which may be made under a Rule 10b5-1 plan.

Repurchased shares may be retired immediately and resume the status of authorized but unissued shares or may be held by us as

treasury stock. The 2014 repurchase authorization may be modified, suspended, or discontinued by our Board at any time. As

of December 30, 2014, under the 2014 repurchase authorization, we have repurchased 427,521 shares at a weighted-average price

of $155.78 for an aggregate purchase price of approximately $66.6 million. We have approximately $533.4 million available

under the 2014 repurchase authorization.

In total, during fiscal 2014, we repurchased 941,878 shares under the 2012 and 2014 repurchase authorizations, at an average price

of $163.62 per share, for an aggregate purchase price of approximately $154.1 million.

We have historically repurchased shares of our Class A common stock from participants of the Panera Bread 1992 Stock Incentive

Plan and the Panera Bread 2006 Stock Incentive Plan, as amended, or collectively, the Plans, through a share repurchase

authorization approved by our Board. Repurchased shares are netted and surrendered as payment for applicable tax withholding

on the vesting of participants’ restricted stock. During fiscal 2014, we repurchased 35,461 shares of Class A common stock

surrendered by participants of the Plans at a weighted-average price of $151.17 per share for an aggregate purchase price of

approximately $5.4 million. During fiscal 2013, we repurchased 41,601 shares of Class A common stock surrendered by

participants of the Plans at a weighted-average price of $172.79 per share for an aggregate purchase price of approximately $7.2

million. During fiscal 2012, we repurchased 42,100 shares of Class A common stock surrendered by participants of the Plans at

a weighted-average price of $156.53 per share for an aggregate purchase price of $6.6 million. These share repurchases were

made pursuant to the terms of the Plans and the applicable award agreements and were not made pursuant to publicly announced

share repurchase authorizations.

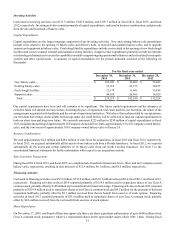

Term Loan

On June 11, 2014, we entered into a term loan agreement, or the Term Loan Agreement, with Bank of America, N.A., as

administrative agent, and other lenders party thereto. The Term Loan Agreement provides for an unsecured term loan, or the Term

Loan, in the amount of $100 million that bears interest at a rate equal to, at our option, (1) LIBOR plus a margin ranging from

1.00 percent to 1.50 percent depending on our consolidated leverage ratio or (2) the highest of (a) the Bank of America prime rate,

(b) the Federal funds rate plus 0.50 percent or (c) LIBOR plus 1.00 percent, plus a margin ranging from 0.00 percent to 0.50

percent depending on our consolidated leverage ratio. Our obligations under the Term Loan Agreement are guaranteed by certain

of our direct and indirect subsidiaries. The Term Loan Agreement also allows us from time to time to request that the Term Loan

be further increased by an amount not to exceed, in the aggregate, $150 million, subject to the arrangement of additional

commitments with financial institutions acceptable to us and Bank of America and other customary terms and conditions. The

Term Loan Agreement contains various financial covenants that, among other things, require us to maintain certain leverage and

fixed charge coverage ratios. The Term Loan is scheduled to mature on June 11, 2019, subject to acceleration upon certain specified

events of defaults, including breaches of representations or covenants, failure to pay other material indebtedness or a change of

control of the Company, as defined in the Term Loan Agreement. We expect to use the proceeds from the Term Loan for general

corporate purposes. As of December 30, 2014, we were, and expect to remain, in compliance with all covenant requirements

under the Term Loan Agreement.