Panera Bread 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

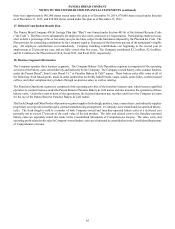

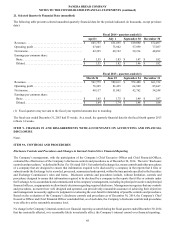

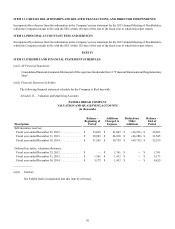

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

61

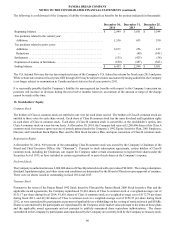

Share Repurchase Authorization

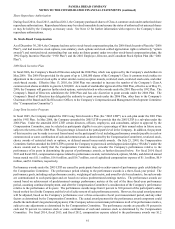

During fiscal 2014, fiscal 2013, and fiscal 2012, the Company purchased shares of Class A common stock under authorized share

repurchase authorizations. Repurchased shares may be retired immediately and resume the status of authorized but unissued shares

or may be held by the Company as treasury stock. See Note 12 for further information with respect to the Company’s share

repurchase authorizations.

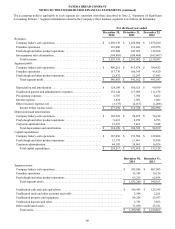

16. Stock-Based Compensation

As of December 30, 2014, the Company had one active stock-based compensation plan, the 2006 Stock Incentive Plan (the “2006

Plan”), and had incentive stock options, non-statutory stock options and stock settled appreciation rights (collectively “option

awards”) and restricted stock outstanding (but can make no future grants) under two other stock-based compensation plans, the

1992 Equity Incentive Plan (the “1992 Plan”) and the 2001 Employee, Director, and Consultant Stock Option Plan (the “2001

Plan”).

2006 Stock Incentive Plan

In fiscal 2006, the Company’s Board of Directors adopted the 2006 Plan, which was approved by the Company’s stockholders in

May 2006. The 2006 Plan provided for the grant of up to 1,500,000 shares of the Company’s Class A common stock (subject to

adjustment in the event of stock splits or other similar events) as option awards, restricted stock, restricted stock units, and other

stock-based awards. Effective May 13, 2010, the 2006 Plan was amended to increase the number of the Company’s Class A

common stock shares available to grant to 2,300,000. As a result of stockholder approval of the 2006 Plan, effective as of May 25,

2006, the Company will grant no further stock options, restricted stock or other awards under the 2001 Plan or the 1992 Plan. The

Company’s Board of Directors administers the 2006 Plan and has sole discretion to grant awards under the 2006 Plan. The

Company’s Board of Directors has delegated the authority to grant awards under the 2006 Plan, other than to the Company’s

Chairman of the Board and Chief Executive Officer, to the Company’s Compensation and Management Development Committee

(the “Compensation Committee”).

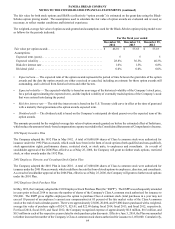

Long-Term Incentive Program

In fiscal 2005, the Company adopted the 2005 Long Term Incentive Plan (the “2005 LTIP”) as a sub-plan under the 2001 Plan

and the 1992 Plan. In May 2006, the Company amended the 2005 LTIP to provide that the 2005 LTIP is a sub-plan under the

2006 Plan. Under the amended 2005 LTIP, certain directors, officers, employees, and consultants, subject to approval by the

Compensation Committee, may be selected as participants eligible to receive a percentage of their annual salary in future years,

subject to the terms of the 2006 Plan. This percentage is based on the participant's level in the Company. In addition, the payment

of this incentive can be made in several forms based on the participant's level including performance awards (payable in cash or

common stock or some combination of cash and common stock as determined by the Compensation Committee), restricted stock,

choice awards of restricted stock or options, or deferred annual bonus match awards. On July 23, 2009, the Compensation

Committee further amended the 2005 LTIP to permit the Company to grant stock settled appreciation rights (“SSARs”) under the

choice awards and to clarify that the Compensation Committee may consider the Company’s performance relative to the

performance of its peers in determining the payout of performance awards, as further discussed below. For fiscal 2014, fiscal

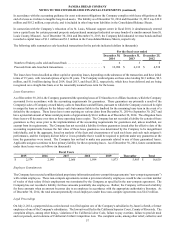

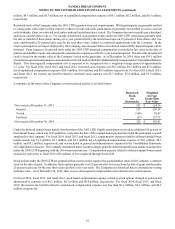

2013 and fiscal 2012, compensation expense related to performance awards, restricted stock, options, SSARs, and deferred annual

bonus match was $11.1 million, $16.0 million, and $16.7 million, net of capitalized compensation expense of $1.1 million, $0.9

million, and $1.0 million, respectively.

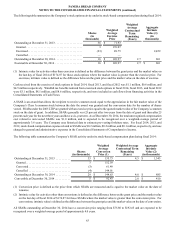

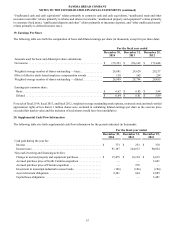

Performance awards under the 2005 LTIP are earned by participants based on achievement of performance goals established by

the Compensation Committee. The performance period relating to the performance awards is a three-fiscal-year period. The

performance goals, including each performance metric, weighting of each metric, and award levels for each metric, for such awards

are communicated to each participant and are based on various predetermined earnings metrics. The performance awards are

earned based on achievement of predetermined earnings performance metrics at the end of the three-fiscal-year performance

period, assuming continued employment, and after the Compensation Committee’s consideration of the Company’s performance

relative to the performance of its peers. The performance awards range from 0 percent to 300 percent of the participant's salary

based on their level in the Company and the level of achievement of each performance metric. However, the actual award payment

will be adjusted, based on the Company’s performance over a three-consecutive fiscal year measurement period, and any other

factors as determined by the Compensation Committee. The actual award payment for the performance award component could

double the individual’s targeted award payment, if the Company achieves maximum performance in all of its performance metrics,

subject to any adjustments as determined by the Compensation Committee. The performance awards are payable 50 percent in

cash and 50 percent in common stock or some combination of cash and common stock as determined by the Compensation

Committee. For fiscal 2014, fiscal 2013, and fiscal 2012, compensation expense related to the performance awards was $1.2