Panera Bread 2014 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

58

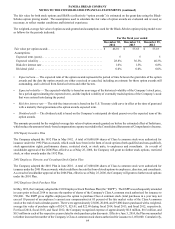

class certification of the lawsuit, unspecified damages, costs and expenses, including attorneys’ fees, and such other relief as the

Court might find just and proper. The Company believes its subsidiary has meritorious defenses to each of the claims in the lawsuit

and is prepared to vigorously defend the lawsuit. There can be no assurance, however, that the Company's subsidiary will be

successful, and an adverse resolution of the lawsuit could have a material adverse effect on the Company's consolidated financial

position and results of operations in the period in which the lawsuit is resolved. The Company is not presently able to reasonably

estimate potential losses, if any, related to the lawsuit.

In addition to the legal matter described above, the Company is subject to various legal proceedings, claims, and litigation that

arise in the ordinary course of its business. Defending lawsuits requires significant management attention and financial resources

and the outcome of any litigation, including the matter described above, is inherently uncertain. The Company does not believe

the ultimate resolution of these actions will have a material adverse effect on its consolidated financial statements. However, a

significant increase in the number of these claims, or one or more successful claims under which the Company incurs greater

liabilities than is currently anticipated, could materially and adversely affect its consolidated financial statements.

Other

The Company is subject to on-going federal and state income tax audits and sales and use tax audits. The Company does not

believe the ultimate resolution of these actions will have a material adverse effect on its consolidated financial statements. However,

a significant increase in the number of these audits, or one or more audits under which the Company incurs greater liabilities than

is currently anticipated, could materially and adversely affect its consolidated financial statements. The Company believes reserves

for these matters are adequately provided for in its consolidated financial statements.

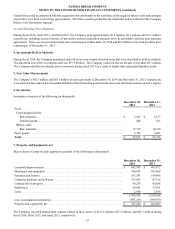

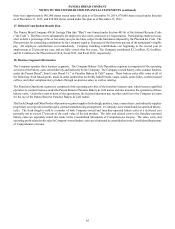

14. Income Taxes

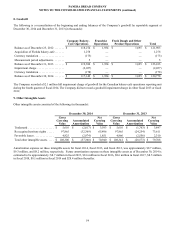

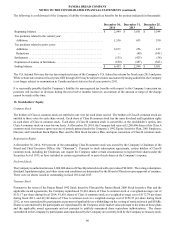

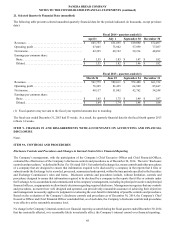

The components of income (loss) before income taxes, by tax jurisdiction, were as follows for the periods indicated (in thousands):

For the fiscal year ended

December 30,

2014

December 31,

2013

December 25,

2012

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 285,564 $ 317,479 $ 286,702

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,270)(4,759)(3,706)

Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 277,294 $ 312,720 $ 282,996

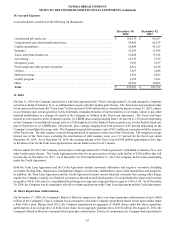

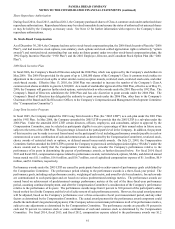

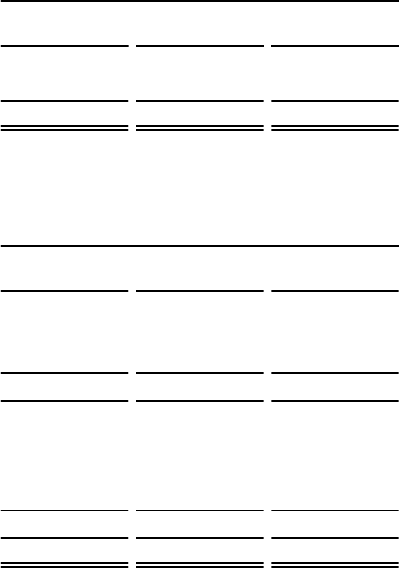

The provision for income taxes consisted of the following for the periods indicated (in thousands):

For the fiscal year ended

December 30,

2014

December 31,

2013

December 25,

2012

Current:

U.S. federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 73,234 $ 87,548 $ 72,434

U.S. state and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,306 18,638 15,955

87,540 106,186 88,389

Deferred:

U.S. federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,609 8,547 16,640

U.S. state and local . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 950 1,804 3,603

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (98) 14 916

$ 10,461 $ 10,365 $ 21,159

Total provision for income taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 98,001 $ 116,551 $ 109,548