Panera Bread 2014 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

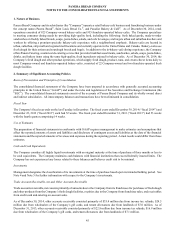

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

53

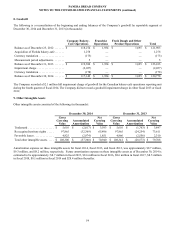

Goodwill recorded in connection with this acquisition was attributable to the workforce of the acquired bakery-cafes and synergies

expected to arise from cost savings opportunities. All of the recorded goodwill is tax deductible and is included in the Company

Bakery-Cafe Operations segment.

Accrued Purchase Price Payments

During fiscal 2014, fiscal 2013, and fiscal 2012, the Company paid approximately $0.3 million, $4.1 million, and $2.1 million,

respectively, including accrued interest, of previously accrued acquisition purchase price in accordance with the asset purchase

agreements. There was no accrued purchase price remaining as of December 30, 2014 and $0.3 million of accrued purchase price

remaining as of December 31, 2013.

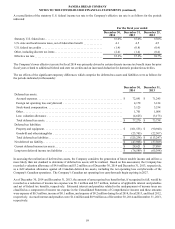

4. Investments Held to Maturity

During fiscal 2013, the Company purchased and sold seven zero-coupon discount notes that were classified as held-to-maturity.

The amortized cost of the investments sold was $97.9 million. The Company realized a loss on the sale of less than $0.1 million.

The Company sold the investments prior to maturity during fiscal 2013 as a result of higher than anticipated liquidity needs.

5. Fair Value Measurements

The Company’s $92.3 million and $18.1 million in cash equivalents at December 30, 2014 and December 31, 2013, respectively,

were carried at fair value in the Consolidated Balance Sheets based on quoted market prices for identical securities (Level 1 inputs).

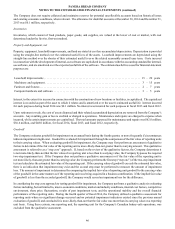

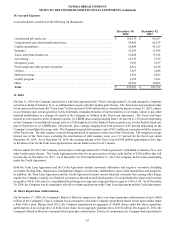

6. Inventories

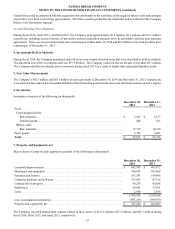

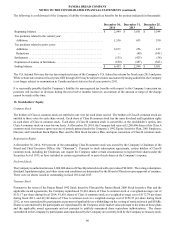

Inventories consisted of the following (in thousands):

December 30,

2014

December 31,

2013

Food:

Fresh dough facilities:

Raw materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,413 $ 3,377

Finished goods. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 460 545

Bakery-cafes:

Raw materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,152 14,329

Paper goods. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,786 3,665

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 22,811 $ 21,916

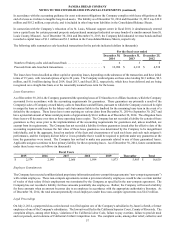

7. Property and Equipment, net

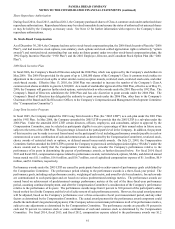

Major classes of property and equipment consisted of the following (in thousands):

December 30,

2014

December 31,

2013

Leasehold improvements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 693,503 $ 607,472

Machinery and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 340,854 305,060

Furniture and fixtures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 167,383 149,445

Computer hardware and software. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 137,663 87,316

Construction in progress. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 99,255 80,108

Smallwares . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29,841 27,031

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,060 2,856

1,470,559 1,259,288

Less: accumulated depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (683,265)(589,879)

Property and equipment, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 787,294 $ 669,409

The Company recorded depreciation expense related to these assets of $115.4 million, $97.2 million, and $82.7 million during

fiscal 2014, fiscal 2013, and fiscal 2012, respectively.