Panera Bread 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

55

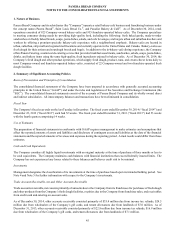

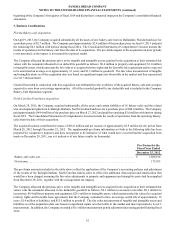

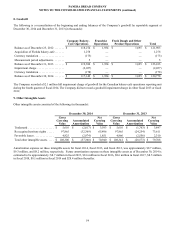

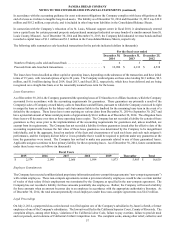

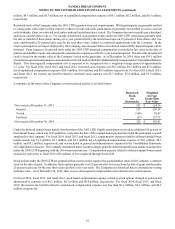

10. Accrued Expenses

Accrued expenses consisted of the following (in thousands):

December 30,

2014

December 31,

2013

Unredeemed gift cards, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 105,576 $ 86,287

Compensation and related employment taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59,442 60,123

Capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56,808 41,329

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32,559 31,545

Taxes, other than income tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,068 17,618

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,147 5,729

Occupancy costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,263 5,017

Fresh dough and other product operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,812 8,236

Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,527 5,488

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,291 2,852

Loyalty program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,525 3,362

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,183 18,206

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 333,201 $ 285,792

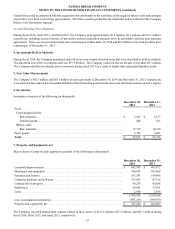

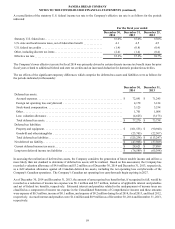

11. Debt

On June 11, 2014, the Company entered into a term loan agreement (the “Term Loan Agreement”), by and among the Company,

as borrower, Bank of America, N.A., as administrative agent, and other lenders party thereto. The Term Loan Agreement provides

for an unsecured term loan (the "Term Loan") in the amount of $100 million that is scheduled to mature on June 11, 2019, subject

to acceleration upon certain specified events of defaults, including breaches of representations or covenants, failure to pay other

material indebtedness or a change of control of the Company, as defined in the Term Loan Agreement. The Term Loan bears

interest at a rate equal to, at the Company's option, (1) LIBOR plus a margin ranging from 1.00 percent to 1.50 percent depending

on the Company’s consolidated leverage ratio or (2) the highest of (a) the Bank of America prime rate, (b) the Federal funds rate

plus 0.50 percent or (c) LIBOR plus 1.00 percent, plus a margin ranging from 0.00 percent to 0.50 percent depending on the

Company’s consolidated leverage ratio. The Company incurred debt issuance costs of $0.2 million in connection with the issuance

of the Term Loan. The debt issuance costs are being amortized to expense over the term of the Term Loan. The weighted-average

interest rate of the Term Loan, excluding the amortization of debt issuance costs, was 1.15 percent for the fiscal year ended

December 30, 2014. As of December 30, 2014, the carrying amount of the Term Loan of $100 million approximates fair value

as the interest rate on the Term Loan approximates current market rates (Level 2 inputs).

On November 30, 2012, the Company entered into a credit agreement (the "Credit Agreement") with Bank of America, N.A. and

other lenders party thereto. The Credit Agreement provides for an unsecured revolving credit facility of $250 million that will

become due on November 30, 2017. As of December 30, 2014 and December 31, 2013, the Company had no loans outstanding

under the Credit Agreement.

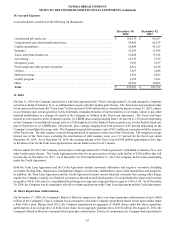

Both the Term Loan Agreement and the Credit Agreement contain customary affirmative and negative covenants, including

covenants limiting liens, dispositions, fundamental changes, investments, indebtedness, and certain transactions and payments.

In addition, the Term Loan Agreement and the Credit Agreement contain various financial covenants that, among other things,

require the Company to satisfy two financial covenants at the end of each fiscal quarter: (1) a consolidated leverage ratio less than

or equal to 3.00 to 1.00, and (2) a consolidated fixed charge coverage ratio of greater than or equal to 2.00 to 1.00. As of December

30, 2014, the Company was in compliance with all covenant requirements in the Term Loan Agreement and the Credit Agreement.

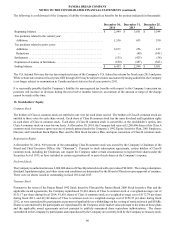

12. Share Repurchase Authorization

On November 17, 2009, the Company's Board of Directors approved a three year share repurchase authorization of up to $600

million of the Company's Class A common stock, pursuant to which the Company repurchased shares on the open market under

a Rule 10b5-1 plan. During fiscal 2012, the Company repurchased an aggregate of 34,600 shares under this share repurchase

authorization, at an average price of $144.24 per share, for an aggregate purchase price of $5.0 million. On August 23, 2012, the

Company's Board of Directors terminated this repurchase authorization. Prior to its termination, the Company had repurchased a