Panera Bread 2014 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

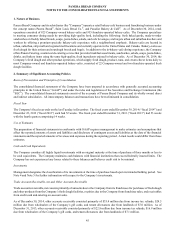

our ability to continue as a going concern. This update is effective for the annual period ending after December 15, 2016, and for

annual and interim periods thereafter. Early adoption is permitted. We are currently evaluating the effect of the standard but its

adoption is not expected to have an impact on our consolidated financial statements.

In May 2014, the FASB issued Accounting Standards Update 2014-09, “Revenue from Contracts with Customers (Topic 606)”.

This update provides a comprehensive new revenue recognition model that requires a company to recognize revenue to depict the

transfer of goods or services to a customer at an amount that reflects the consideration it expects to receive in exchange for those

goods or services. The guidance also requires additional disclosure about the nature, amount, timing and uncertainty of revenue

and cash flows arising from customer contracts. This update is effective for annual and interim periods beginning after December

15, 2016, which will require us to adopt these provisions in the first quarter of fiscal 2017. Early application is not permitted.

This update permits the use of either the retrospective or cumulative effect transition method. We are evaluating the impact this

guidance will have on our consolidated financial statements and related disclosures. We have not yet selected a transition method

nor have we determined the effect of the standard on our ongoing financial reporting.

In July 2013, the FASB issued Accounting Standards Update No. 2013-11, “Income Taxes (Topic 740): Presentation of an

Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists”.

This guidance requires an unrecognized tax benefit related to a net operating loss carryforward, a similar tax loss or a tax credit

carryforward to be presented as a reduction to a deferred tax asset, unless the tax benefit is not available at the reporting date to

settle any additional income taxes under the tax law of the applicable tax jurisdiction. The guidance became effective for us at the

beginning of our first quarter of fiscal 2014 and did not have a material impact on our consolidated financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

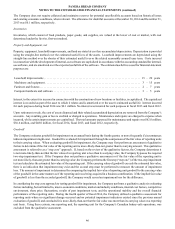

Commodity Risk

We manage our commodity risk in several ways. We purchase certain commodities, such as flour, coffee, and proteins, for use in

our business. These commodities are sometimes purchased under agreements with terms of one month to one year, usually at a

fixed price. As a result, we are subject to market risk that current market prices may be above or below our contractual price. In

fiscal 2014, 2013, and 2012, we did not utilize derivative instruments in managing commodity risk.

Interest Rate Sensitivity

We are exposed to market risk primarily from fluctuations in interest rates on our $100 million term loan and any borrowings we

may make under our credit facility of $250 million. Under the term loan and credit facility, we may select interest rates equal to

(1) LIBOR plus the Applicable Rate for LIBOR loans (which is an amount ranging from 1.00 percent to 1.50 percent for the term

loan and 1.00 to 2.00 percent for the credit facility depending on our consolidated leverage ratio) or (2) the Base Rate (which is

defined as the highest of the Bank of America prime rate, the Federal funds rate plus 0.50 percent, or LIBOR plus 1.00 percent)

plus the Applicable Rate for Base Rate loans (which is an amount ranging from 0.00 percent to 0.50 percent for the term loan and

0.00 percent to 1.00 percent for the credit facility depending on our consolidated leverage ratio). The effective interest rate on the

term loan borrowings was 1.15% as of December 30, 2014. An increase in the present interest rate of 100 basis points on the

term loan borrowings would increase annual interest expense by approximately $1.2 million. We did not have an outstanding

balance on our credit facility at December 30, 2014 or December 31, 2013. We may have future borrowings under our credit

facility, which could result in an interest rate change that may have an impact on our consolidated results of operations.

Foreign Currency Exchange Risk

As of December 30, 2014, we had nine Canadian Company-owned bakery-cafes, one Canadian Company-owned fresh dough

facility, and six Canadian franchise-operated bakery-cafes. As a result, certain of our operating revenues, expenses, and capital

purchasing activities are subject to fluctuations in the exchange rate of the Canadian Dollar. To date, we have not entered into

any hedging contracts, although we may do so in the future. Fluctuations in currency exchange rates could affect our business in

the future.