Panera Bread 2014 Annual Report Download - page 46

Download and view the complete annual report

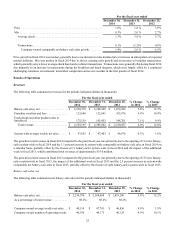

Please find page 46 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

result in the recognition of revenue. When gift cards are redeemed at Company-owned bakery-cafes, we recognize revenue and

reduce the gift card liability. When we determine the likelihood of the gift card being redeemed by the customer is remote ("gift

card breakage"), based upon our specific historical redemption patterns, and there is no legal obligation to remit the unredeemed

gift card balance in the relevant jurisdiction, gift card breakage is recorded as a reduction of general and administrative expenses

in the Consolidated Statements of Comprehensive Income; however, such gift cards will continue to be honored. We recognized

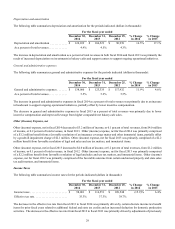

gift card breakage as a reduction of general and administrative expenses of $4.9 million for fiscal 2014, $2.8 million for fiscal

2013, and $1.8 million for fiscal 2012. Incremental direct costs related to the sale of gift cards are deferred until the associated

gift card is redeemed or breakage is deemed appropriate. These deferred incremental direct costs are reflected as a reduction of

the unredeemed gift card liability, net which is a component of accrued expenses in the Consolidated Balance Sheets and, when

recognized, as a reduction of bakery-cafe sales, net in the Consolidated Statements of Comprehensive Income.

Valuation of Goodwill

We evaluate goodwill for impairment on an annual basis during our fourth quarter, or more frequently if circumstances indicate

impairment might exist. Goodwill is evaluated for impairment through the comparison of fair value of our reporting units to their

carrying values. When evaluating goodwill for impairment, we may first perform an assessment of qualitative factors to determine

if the fair value of the reporting unit is more-likely-than-not greater than its carrying amount. This qualitative assessment is referred

to as a “step zero” approach. If, based on the review of the qualitative factors, we determine it is not more-likely-than-not that

the fair value of a reporting unit is less than its carrying value, we bypass the required two-step impairment test. If we do not

perform a qualitative assessment or if the fair value of the reporting unit is not more-likely- than-not greater than its carrying value,

we perform the first step, which is referred to as step one, of the two-step impairment test, and calculate the estimated fair value

of the reporting unit. If the carrying value of goodwill exceeds the estimated fair value, there is an indication that impairment

may exist and the second step must be performed to measure the amount of impairment loss. The amount of impairment is

determined by comparing the implied fair value of the reporting unit goodwill to the carrying value of the goodwill in the same

manner as if the reporting unit was being acquired in a business combination. If the implied fair value of goodwill is less than

the recorded goodwill, we would record an impairment loss for the difference.

In considering the step zero approach to testing goodwill for impairment, we perform a qualitative analysis evaluating factors

including, but not limited to, macro-economic conditions, market and industry conditions, internal cost factors, competitive

environment, share price fluctuations, results of past impairment tests, and the operational stability and the overall financial

performance of the reporting units. During the fourth quarter of fiscal 2014, we utilized a qualitative assessment for reporting

units where no significant change occurred and no potential impairment indicators existed since the previous annual evaluation

of goodwill, and concluded it is more-likely-than-not that the fair value was more than its carrying value on a reporting unit basis.

Using these criteria, one reporting unit, the reporting unit for our Canadian bakery-cafe operations, was excluded from the qualitative

assessment.

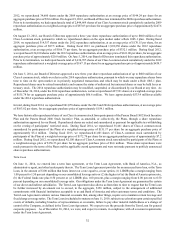

In considering the step one approach to testing goodwill for impairment, we utilized a quantitative assessment to test goodwill for

impairment for the Canadian reporting unit during the fourth quarter of fiscal 2014. The fair value of a reporting unit is the price

a willing buyer would pay for the reporting unit and is estimated using a discounted cash flow model. Our discounted cash flow

estimate was based upon, among other things, certain assumptions about expected future operating performance, such as revenue

growth rates, operating margins, risk-adjusted discount rates, and future economic and market conditions. We determined the

carrying value of the Canadian reporting unit exceeded its fair value and thus step two of the goodwill impairment test was

completed. The step two analysis indicated the entire balance of goodwill for the Canadian reporting unit was impaired and we

recorded a full goodwill impairment charge of $2.1 million. This charge was recorded in other (income) expense, net in the

Consolidated Statements of Comprehensive Income.

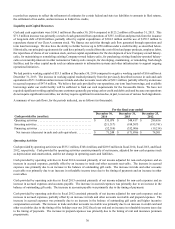

At December 30, 2014 and December 31, 2013, our goodwill balance was $120.8 million and $123.0 million, respectively. No

impairment loss was recognized during either fiscal 2013 or fiscal 2012, respectively.

Self-Insurance

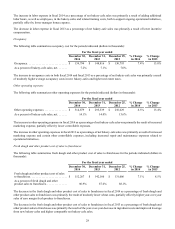

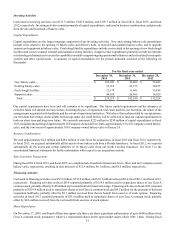

We are self-insured for a significant portion of our workers’ compensation, group health, and general, auto, and property liability

insurance, with varying levels of deductibles of as much as $0.8 million of individual claims, depending on the type of claim. We

also purchase aggregate stop-loss and/or layers of loss insurance in many categories of loss. We utilize third party actuarial experts’

estimates of expected losses based on statistical analyses of historical industry data, as well as our own estimates based on our

actual historical data to determine required self-insurance reserves. The assumptions are closely reviewed, monitored, and adjusted

when warranted by changing circumstances. These estimated liabilities could be affected if actual experience related to the number

of claims and cost per claim differs from these assumptions and historical trends. Based on information known at December 30,

2014, we believe we have provided adequate reserves for our self-insurance exposure. We held self-insurance reserves of $32.6