Panera Bread 2014 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

64

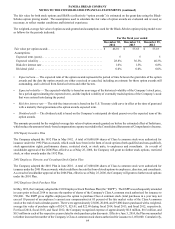

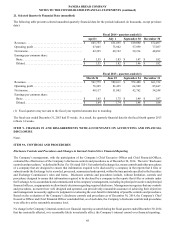

The fair value for both stock options and SSARs (collectively “option awards”) is estimated on the grant date using the Black-

Scholes option pricing model. The assumptions used to calculate the fair value of option awards are evaluated and revised, as

necessary, to reflect market conditions and historical experience.

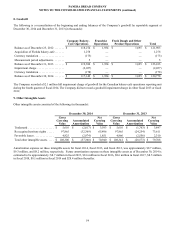

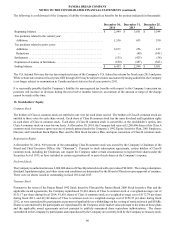

The weighted-average fair value of option awards granted and assumptions used for the Black-Scholes option pricing model were

as follows for the periods indicated:

For the fiscal year ended

December 30,

2014

December 31,

2013

December 25,

2012

Fair value per option awards. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 46.01 $ 55.63 $ 53.18

Assumptions:

Expected term (years) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 5 5

Expected volatility . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28.8% 36.5% 40.3%

Risk-free interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.6% 1.3% 0.8%

Dividend yield . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.0% 0.0% 0.0%

• Expected term — The expected term of the option awards represents the period of time between the grant date of the option

awards and the date the option awards are either exercised or canceled, including an estimate for those option awards still

outstanding, and is derived from historical terms and other factors.

• Expected volatility — The expected volatility is based on an average of the historical volatility of the Company’s stock price,

for a period approximating the expected term, and the implied volatility of externally traded options of the Company’s stock

that were entered into during the period.

• Risk-free interest rate — The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant and

with a maturity that approximates the option awards expected term.

• Dividend yield — The dividend yield is based on the Company’s anticipated dividend payout over the expected term of the

option awards.

The amounts presented for the weighted-average fair value of option awards granted are before the estimated effect of forfeitures,

which reduce the amount of stock-based compensation expense recorded in the Consolidated Statements of Comprehensive Income.

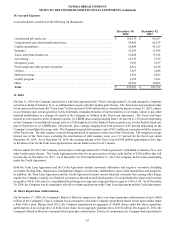

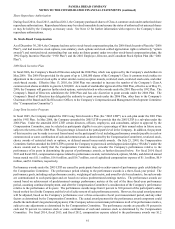

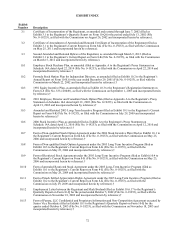

1992 Equity Incentive Plan

The Company adopted the 1992 Plan in May 1992. A total of 8,600,000 shares of Class A common stock were authorized for

issuance under the 1992 Plan as awards, which could have been in the form of stock options (both qualified and non-qualified),

stock appreciation rights, performance shares, restricted stock, or stock units, to employees and consultants. As a result of

stockholder approval of the 2006 Plan, effective as of May 25, 2006, the Company will grant no further stock options, restricted

stock, or other awards under the 1992 Plan.

2001 Employee, Director, and Consultant Stock Option Plan

The Company adopted the 2001 Plan in June 2001. A total of 3,000,000 shares of Class A common stock were authorized for

issuance under the 2001 Plan as awards, which could have been in the form of stock options to employees, directors, and consultants.

As a result of stockholder approval of the 2006 Plan, effective as of May 25, 2006, the Company will grant no further stock options

under the 2001 Plan.

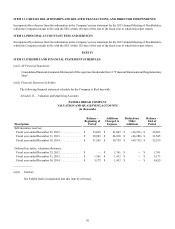

1992 Employee Stock Purchase Plan

In May 1992, the Company adopted the 1992 Employee Stock Purchase Plan (the “ESPP”). The ESPP was subsequently amended

in years prior to fiscal 2014 to increase the number of shares of the Company's Class A common stock authorized for issuance to

950,000. The ESPP gives eligible employees the option to purchase Class A common stock (total purchases in a year may not

exceed 10 percent of an employee’s current year compensation) at 85 percent of the fair market value of the Class A common

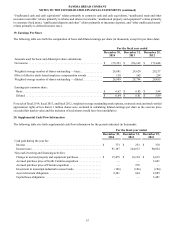

stock at the end of each calendar quarter. There were approximately 23,000, 20,000, and 19,000 shares purchased with a weighted-

average fair value of purchase rights of $24.71, $25.01, and $22.68 during fiscal 2014, fiscal 2013, and fiscal 2012, respectively.

For fiscal 2014, fiscal 2013, and fiscal 2012, the Company recognized expense of approximately $0.6 million, $0.5 million, and

$0.5 million in each of the respective years related to stock purchase plan discounts. Effective June 5, 2014, the Plan was amended

to further increase the number of the Company’s Class A common stock shares authorized for issuance to 1,050,000. Cumulatively,