Panera Bread 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

(4) Represents estimated interest payments on the term loan borrowings. Interest payments are calculated based on LIBOR plus

the applicable margin in effect at December 30, 2014, or 1.15%. The actual interest rates on our term loan borrowings could

vary from that used to compute the above interest payments. See Note 11 to the consolidated financial statements for further

information with respect to our term loan borrowings.

(5) See Note 14 to the consolidated financial statements for further information with respect to our uncertain tax positions.

Off-Balance Sheet Arrangements

As of December 30, 2014, we guaranteed operating leases of 23 franchisee or affiliate locations, which we account for in accordance

with the accounting requirements for guarantees. These guarantees are primarily a result of our sales of Company-owned bakery-

cafes to franchisees and affiliates, pursuant to which we exercised our right to assign the lease or sublease for the bakery-cafe but

remain liable to the landlord for the remaining lease term in the event of a default by the assignee. These leases have terms expiring

on various dates from December 31, 2014 to September 30, 2027 and have a potential amount of future rental payments of

approximately $16.6 million as of December 30, 2014. Our obligation from these leases will decrease over time as these operating

leases expire. We have not recorded a liability for certain of these guarantees as they arose prior to the implementation of the

accounting requirements for guarantees and, unless modified, are exempt from its requirements. We have not recorded a liability

for those guarantees issued after the effective date of the accounting requirements because the fair value of these lease guarantee

was determined by us to be insignificant individually, and in the aggregate, based on analysis of the facts and circumstances of

each such lease and each such assignee's performance, and we did not believe it was probable we would be required to perform

under any guarantees at the time the guarantees were issued. We have not had to make any payments related to any of these

guaranteed leases. Applicable assignees continue to have primary obligation for these operating leases. As of December 30, 2014,

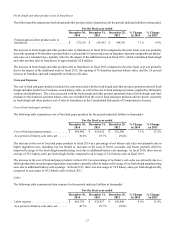

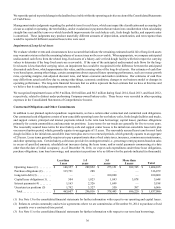

future commitments under these leases were as follows (in thousands):

Less than

1 year

1-3

years

3-5

years

More than

5 years Total

Subleases and Lease Guarantees (1). . . . . . . 2,574 4,206 3,857 5,983 $ 16,620

(1) Represents aggregate minimum requirement — see Note 13 to the consolidated financial statements for further information

with respect to our lease guarantees.

Employee Commitments

We have confidential and proprietary information and non-competition agreements, referred to as non-compete agreements, with

certain employees. These non-compete agreements contain a provision whereby employees would be due a certain number of

weeks of their salary if their employment was terminated by us as specified in the non-compete agreement. We have not recorded

a liability for these amounts potentially due to employees. Rather, we will record a liability for these amounts when an amount

becomes due to an employee in accordance with the appropriate authoritative literature. As of December 30, 2014, the total amount

potentially owed employees under these non-compete agreements was $24.3 million.

Impact of Inflation

Our profitability depends in part on our ability to anticipate and react to changes in food, supply, labor, occupancy, and other costs.

In the past, we have been able to recover a significant portion of inflationary costs and commodity price increases, including price

increases in fuel, proteins, dairy, wheat, tuna, and cream cheese among others, through increased menu prices. There have been,

and there may be in the future, delays in implementing such menu price increases, and competitive pressures may limit our ability

to recover such cost increases in their entirety. Historically, the effects of inflation on our consolidated results of operations have

not been materially adverse. However, inherent volatility experienced in certain commodity markets, such as those for wheat,

proteins, including chicken raised without antibiotics, and fuel may have an adverse effect on us in the future. The extent of the

impact will depend on our ability and timing to increase food prices.

A majority of our associates are paid hourly rates regulated by federal and state minimum wage laws. Although we have and will

continue to attempt to pass along any increased labor costs through food price increases, there can be no assurance that all such

increased labor costs can be reflected in our prices or that increased prices will be absorbed by consumers without diminishing to

some degree consumer spending at the bakery-cafes.

Recent Accounting Pronouncements

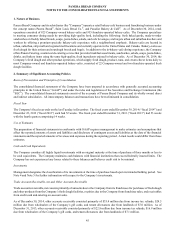

In August 2014, the Financial Accounting Standards Board, or the FASB, issued Accounting Standards Update

2014-15, “Presentation of Financial Statements - Going Concern (Subtopic 205-40); Disclosure of Uncertainties about an Entity’s

Ability to Continue as a Going Concern”. This update requires management to evaluate whether there is substantial doubt about