Panera Bread 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

48

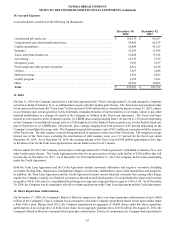

Income Taxes

The Company recognizes deferred tax assets and liabilities for the future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and

liabilities are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recovered or settled. Any effect on deferred tax assets and liabilities from a change in tax rates is

recognized in income in the period that includes the enactment date. A valuation allowance is recognized if the Company determines

it is more likely than not that all or some portion of the deferred tax asset will not be recognized. As of December 30, 2014 and

December 31, 2013 the Company had recorded a valuation allowance related to deferred tax assets of the Company's Canadian

operations of $4.6 million and $3.2 million, respectively.

In accordance with the authoritative guidance on income taxes, the Company establishes additional provisions for income taxes

when, despite the belief that tax positions are fully supportable, there remain certain positions that do not meet the minimum

probability threshold, which is a tax position that is more likely than not to be sustained upon ultimate settlement with tax authorities

assuming full knowledge of the position and all relevant facts. In the normal course of business, the Company and its subsidiaries

are examined by various federal, state, foreign, and other tax authorities. The Company regularly assesses the potential outcomes

of these examinations and any future examinations for the current or prior years in determining the adequacy of its provision for

income taxes. The Company routinely assesses the likelihood and amount of potential adjustments and adjusts the income tax

provision, the current tax liability and deferred taxes in the period in which the facts that give rise to a revision become known.

The Company classifies estimated interest and penalties related to the unrecognized tax benefits as a component of income taxes

in the Consolidated Statements of Comprehensive Income.

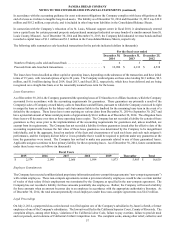

Capitalization of Certain Development Costs

The Company has elected to account for construction costs in accordance with the accounting standard for real estate in the

Company’s consolidated financial statements. The Company capitalizes direct costs clearly associated with the acquisition,

development, design, and construction of bakery-cafe locations and fresh dough facilities as these costs have a future benefit to

the Company. The types of specifically identifiable costs capitalized by the Company include primarily payroll and payroll related

taxes and benefit costs incurred by those individuals directly involved in development activities, including the acquisition,

development, design, and construction of bakery-cafes and fresh dough facilities. The Company does not consider for capitalization

payroll or payroll-related costs incurred by individuals that do not directly support the acquisition, development, design, and

construction of bakery-cafes and fresh dough facilities. The Company uses an activity-based methodology to determine the amount

of costs incurred for Company-owned projects, which are capitalized, and those for franchise-operated projects and general and

administrative activities, which both are expensed as incurred. If the Company subsequently makes a determination that sites for

which development costs have been capitalized will not be acquired or developed, any previously capitalized development costs

are expensed and included in general and administrative expenses in the Consolidated Statements of Comprehensive Income.

The Company capitalized $10.4 million, $9.6 million, and $9.0 million of direct costs related to the development of Company-

owned bakery-cafes during fiscal 2014, fiscal 2013, and fiscal 2012, respectively. The Company amortizes capitalized development

costs for each bakery-cafe and fresh dough facility using the straight-line method over the shorter of their estimated useful lives

or the related reasonably assured lease term and includes such amounts in depreciation and amortization in the Consolidated

Statements of Comprehensive Income. In addition, the Company assesses the recoverability of capitalized costs through the

performance of impairment analyses on an individual bakery-cafe and fresh dough facility basis pursuant to the accounting standard

for property and equipment, net specifically related to the accounting for the impairment or disposal of long-lived assets.

Deferred Financing Costs

Debt issuance costs incurred in connection with the issuance of long-term debt are capitalized and amortized to interest expense

based on the related debt agreement using the straight-line method, which approximates the effective interest method. The

unamortized amounts are included in deposits and other assets in the Consolidated Balance Sheets and were $0.8 million at both

December 30, 2014 and December 31, 2013, respectively.

Revenue Recognition

The Company records revenues from bakery-cafe sales upon delivery of the related food and other products to the customer.

Revenues from fresh dough and other product sales to franchisees are recorded upon delivery to the franchisees. Sales of soup

and other branded products outside of the Company's bakery-cafes are recognized upon delivery to customers.

Franchise fees are the result of the sale of area development rights and the sale of individual franchise locations to third parties.

The initial franchise fee is generally $35,000 per bakery-cafe to be developed under an Area Development Agreement, or ADA.