Nordstrom 2008 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Nordstrom, Inc. and subsidiaries 7

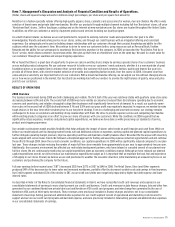

CONSUMER CREDIT

Our credit card operations drive sales in our stores, allow our stores to avoid third-party transaction fees and generate additional revenues by

extending credit. Our credit card revenue is subject to changes in interest rates which fluctuate based on market conditions. The market conditions

influencing interest rates are based on economic factors that are beyond our control and include, but are not limited to, recession, inflation, deflation,

consumer credit availability, consumer debt levels, tax rates and policy, unemployment trends and other matters that influence consumer confidence

and spending. Our ability to extend credit to our customers and to collect payments from them depends on many factors including compliance with

applicable laws and regulations, any of which may change from time to time. Changes in credit card use, payment patterns and default rates have

resulted from a variety of economic, legal, social and other factors that we cannot control or predict with certainty. Changes that impact our ability

to extend credit and collect payments have negatively affected our results and may continue in the future.

AVAILABILITY AND COST OF CREDIT

U.S. and global credit and equity markets have recently undergone significant disruption, making it difficult for many businesses to obtain financing on

acceptable terms or at all. As a result of this disruption, we have experienced an increase in the cost of borrowings necessary to operate our business.

If these conditions continue or become worse, our cost of borrowing could continue to increase. It may also become more difficult to obtain financing

for our operations or to refinance long-term obligations as they become payable. In addition, our borrowing costs can be affected by independent

rating agencies’ short and long-term debt ratings which are based largely on our performance as measured by credit metrics including interest

coverage and leverage ratios. A decrease in these ratings would likely also increase our cost of borrowing and make it more difficult for us to obtain

financing. A significant increase in the costs we incur in order to finance our operations may have a material adverse impact on our business results

and financial condition.

SUPPLY CHAIN DISRUPTION

We do not own or operate any manufacturing facilities and depend on independent third-parties to manufacture our merchandise. We may experience

operational difficulties with our vendors, such as the availability of production capacity, errors in meeting merchandise specifications, insufficient

quality control, failures to meet production deadlines or increases in manufacturing costs. A vendor’s failure to ship merchandise to us on a timely

basis or to meet the required quality standards could cause supply shortages and could result in lost sales. We depend on the orderly operation of the

receiving and distribution process, which depends, in turn, on adherence to shipping schedules and effective management of our six distribution

centers and our Direct fulfillment center. We believe that our receiving and distribution process is efficient. However, unforeseen disruptions in

operations due to fires, hurricanes or other catastrophic events, labor disagreements or shipping problems, may result in delays in the delivery of

merchandise to our stores or our customers and could increase our costs. Although we maintain business interruption and property insurance, if any

of the distribution centers or our fulfillment center is shut down for any reason, our insurance coverage may not be sufficient or we may not receive

insurance proceeds in a timely manner.

RELATIONSHIP WITH VENDORS AND DEVELOPERS

Our relationships with our vendors and developers have been a significant contributor to our past success and our position as a retailer of high-quality

and fashion merchandise. Some of our vendors and developers have experienced serious cash flow problems due to the credit market crisis. In

addition, the recent economic deterioration has reduced the availability of funds for vendors and developers.

We depend on the work of our developer partners to be able to sustain our store growth plan. In the case of developer delays of shopping center

expansion, renovation or construction projects or developer bankruptcies, our expected store openings or remodels could be further delayed or

cancelled, and maintenance and leasing at some shopping centers in which we have stores could be adversely affected.

Many of our key vendors limit the number of retail channels they use to sell their merchandise and competition to obtain and sell these goods is

intense. Nearly all of the brands of our top vendors are sold by competing retailers, and many of our top vendors also have their own dedicated retail

stores. If one or more of our top vendors were to increase sales of merchandise through their own stores or to the stores of our competitors, our

business could be adversely affected. We have no guaranteed supply arrangements with our principal merchandising sources. To counteract cash flow

problems, our vendors could attempt to increase their prices, pass through increased costs, alter payment terms or seek other relief. Accordingly,

there can be no assurance that our vendors will continue to meet our quality, style or volume requirements. Our vendors may be forced to reduce their

operations or file for bankruptcy protection, which in some cases would make it difficult for us to serve the market’s needs and could have a material

adverse effect on our business.

GEOGRAPHIC LOCATION OF STORES

A significant amount of our total sales are derived from stores located on the west and east coasts, particularly California, which increases our

dependence on local economic conditions within these states. The success of our credit card business is also highly dependent on our customers’

ability to pay and our ability to minimize risk when extending credit to cardholders. Deterioration in economic conditions and consumer confidence

within these states has negatively impacted our business, including a reduction in overall sales, reduced gross margins and increased expenses

including bad debt expense. These trends could become worse if these factors continue.

LEADERSHIP DEVELOPMENT AND SUCCESSION PLANNING

The training and development of our future leaders is important to our long-term growth. If we do not effectively implement our strategic and business

planning processes to train and develop future leaders, our long-term growth may suffer. We rely on the experience of our senior management, who

have specific knowledge relating to us and our industry that is difficult to replace. If unexpected leadership turnover occurs without adequate

succession plans, the loss of the services of any of these individuals, or any negative perceptions of our business as a result of those losses, could

damage our brand image and our business. Our operations could be adversely affected if we cannot attract and retain qualified key personnel.